2K Sports 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

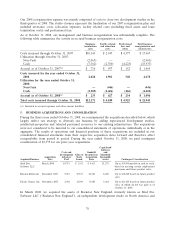

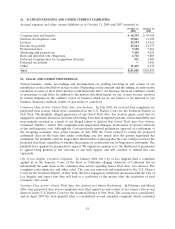

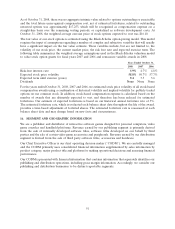

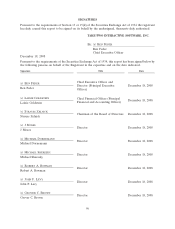

A reconciliation of our effective tax rate to the U.S. statutory federal income tax rate is as follows:

Years Ended October 31,

2008 2007 2006

U.S. federal statutory rate 35.0% (35.0)%(35.0)%

Foreign tax rate differential (19.2)% 8.6% 0.5%

State and local taxes, net of U.S. federal benefit 2.0% (0.5)% 1.0%

Federal valuation allowance (8.5)% 28.0% 32.5%

Other 4.1% 6.8% 1.2%

Effective tax rate 13.4% 7.9% 0.2%

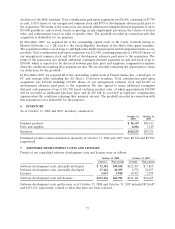

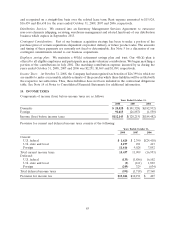

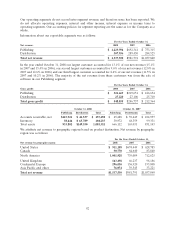

The effects of temporary differences that gave rise to our deferred tax assets and liabilities were as follows:

October 31,

2008 2007

Current deferred tax assets and (liabilities):

Sales returns and allowances (including bad debt) $ 9,129 $ 11,756

Inventory reserves 4,068 3,350

Deferred rent 2,423 3,668

Deferred revenue 13,520 1,980

Capital loss carryforward —6,145

Other 10,462 12,220

Capitalized software and depreciation (33,685) (44,960)

Total current deferred tax asset (liability) 5,917 (5,841)

Less: Valuation allowance (4,468) —

Net current deferred tax asset (liability)(a) 1,449 (5,841)

Non-current deferred tax assets:

Equity compensation 2,558 2,603

Domestic net operating loss carryforward 71,324 94,697

Foreign tax credit carryforward 5,947 3,789

Deferred revenue —14,480

Foreign net operating loss carryforwards 5,350 3,483

Intangible amortization 2,774 4,780

Capitalized software and depreciation 10,573 5,514

Total non-current deferred tax asset 98,526 129,346

Less: Valuation allowance (99,837) (123,616)

Net non-current deferred tax (liability) asset(b) (1,311) 5,730

Deferred taxes, net $ 138 $ (111)

(a) Included in prepaid expenses and other as of October 31, 2008 and accrued expenses and other current liabilities as of

October 31, 2007.

(b) Included in other long-term liabilities as of October 31, 2008 and other assets as of October 31, 2007.

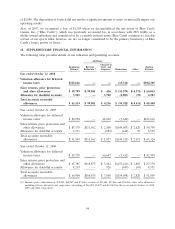

The valuation allowance for deferred taxes is primarily attributable to net operating losses for which no

benefit is provided due to uncertainty with respect to their realization. In addition, during the year ended

October 31, 2008, we recorded a deferred tax benefit of $143 and a corresponding reduction to additional

paid-in-capital for the cancellation of certain stock options.

86