2K Sports 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill and Intangible Assets

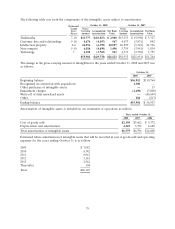

Goodwill is the excess of purchase price paid over identified intangible and tangible net assets of acquired

companies. Intangible assets consist of trademarks, intellectual property, non-compete agreements,

customer lists and acquired technology. Certain intangible assets acquired in a business combination are

recognized as assets apart from goodwill. Identified intangibles other than goodwill are generally

amortized using the straight-line method over the period of expected benefit ranging from three to ten

years, except for intellectual property, which is a usage-based intangible asset that is amortized using the

shorter of the useful life or expected revenue stream.

We perform an annual test for impairment of goodwill in the fourth quarter of each fiscal year or earlier if

indicators of impairment exist. We determine the fair value of each reporting unit using a discounted cash

flow analysis and compare such values to the respective reporting unit’s carrying amount.

Long-lived Assets

We review all long-lived assets whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be recoverable, including assets to be disposed of by sale, whether previously

held and used or newly acquired. We compare the carrying amount of the asset to the estimated

undiscounted future cash flows expected to result from the use of the asset. If the carrying amount of the

asset exceeds estimated expected undiscounted future cash flows, we record an impairment charge for the

difference between the carrying amount of the asset and its fair value. The estimated fair value is generally

measured by discounting expected future cash flows at our incremental borrowing rate or fair value, if

available.

In fiscal 2006, we incurred impairment charges recorded in operating expenses of $15,608 related to

write-offs of fixed assets, trademarks and other assets for the closure of underperforming development

studios and goodwill and fixed asset impairment in connection with our 2006 goodwill impairment testing.

All of such costs were recorded in our publishing segment.

Income Taxes

We recognize deferred taxes under the asset and liability method of accounting for income taxes. Under

the asset and liability method, deferred income taxes are recognized for differences between the financial

statement and tax bases of assets and liabilities at currently enacted statutory tax rates for the years in

which the differences are expected to reverse. The effect on deferred taxes of a change in tax rates is

recognized in income in the period that includes the enactment date. Valuation allowances are established

when we determine that it is more likely than not that such deferred tax assets will not be realized. We do

not record income tax expense related to foreign withholding taxes or United States income taxes which

may become payable upon the repatriation of undistributed earnings of foreign subsidiaries, as such

earnings are expected to be reinvested indefinitely outside of the United States.

We use estimates and assumptions to compute the provision for income taxes including allocations of

certain transactions to different tax jurisdictions, amounts of permanent and temporary differences, the

likelihood of deferred tax assets being recovered and the outcome of contingent tax risks. These estimates

and assumptions are revised as new events occur, more experience is acquired and additional information

is obtained. The impact of these revisions is recorded in income tax expense or benefit in the period in

which they become known.

Revenue Recognition

We earn our revenue from the sale of internally developed interactive software titles and from the sale of

titles developed by and/or licensed from third party developers (‘‘Publishing revenue’’). We also earn

70