2K Sports 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recently Issued Accounting Pronouncements

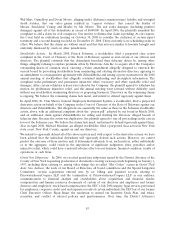

In September 2006, the Financial Accounting Standards Board (‘‘FASB’’) issued Statement of Financial

Accounting Standard (‘‘SFAS’’) No. 157, Fair Value Measurements (‘‘SFAS 157’’), which clarifies the

definition of fair value, establishes a framework for measuring fair value in generally accepted accounting

principles, and expands disclosures about fair value measurement. SFAS 157 does not require any new fair

value measurements and eliminates inconsistencies in guidance found in various prior accounting

pronouncements. SFAS 157 is effective for fiscal years beginning after November 15, 2007 (November 1,

2008 for the Company), and interim periods within those fiscal years. However, on February 12, 2008, the

FASB issued FASB Staff Position (‘‘FSP’’) FAS 157-2 which delays the effective date of SFAS 157 for all

nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in

the financial statements on a recurring basis (at least annually). This FSP partially defers the effective date

of SFAS 157 to fiscal years beginning after November 15, 2008 (November 1, 2009 for the Company), and

interim periods within those fiscal years for items within the scope of this FSP. On October 10, 2008 the

FASB issued FASB issued FSP FAS 157-3, Determining the Fair Value of a Financial Asset When the Market

for That Asset Is Not Active, which clarifies the application of SFAS 157, in a market that is not active. We

do not expect that the adoption of SFAS 157, FSP FAS 157-2 and FSP FAS 157-3 will have a material effect

on our consolidated financial position, cash flows or results of operations.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities (‘‘SFAS 159’’). SFAS 159 expands the use of fair value accounting but does not affect existing

standards, which require assets or liabilities to be carried at fair value. Under SFAS 159, a company may

elect to use fair value to measure certain financial assets and financial liabilities, on an

instrument-by-instrument basis. If the fair value option is elected, unrealized gains and losses on existing

items for which fair value has been elected are reported as a cumulative adjustment to beginning retained

earnings. Subsequent to the adoption of SFAS 159, changes in fair value are recognized in earnings.

SFAS 159 is effective for fiscal years beginning after November 15, 2007 (November 1, 2008 for the

Company), with earlier adoption permitted. We did not adopt SFAS 159 prior to November 1, 2008 and do

not expect it to have a material effect on our consolidated financial position, cash flows or results of

operations.

In June 2007, the FASB ratified the Emerging Issues Task Force’s (‘‘EITF’’) consensus conclusion on

EITF 07-03, Accounting for Nonrefundable Advance Payments for Goods or Services to Be Used in Future

Research and Development. EITF 07-03 addresses the diversity which exists with respect to the accounting

for the non-refundable portion of a payment made by a research and development entity for future

research and development activities. Under this conclusion, an entity is required to defer and capitalize

non-refundable advance payments made for research and development activities until the related goods

are delivered or the related services are performed. EITF 07-03 is effective for interim or annual reporting

periods in fiscal years beginning after December 15, 2007 (November 1, 2008 for the Company), and

requires prospective application for new contracts entered into after the effective date. We do not expect

that the adoption of EITF 07-03 will have a material effect on our consolidated financial position, cash

flows or results of operations.

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations (‘‘SFAS 141(R)’’). This

Statement provides greater consistency in the accounting and financial reporting of business combinations.

It requires the acquiring entity in a business combination to recognize all assets acquired and liabilities

assumed in the transaction, establishes the acquisition-date fair value as the measurement objective for all

assets acquired and liabilities assumed, and requires the acquirer to disclose the nature and financial effect

of the business combination. SFAS 141(R) is effective for all fiscal years beginning after December 15,

2008 (November 1, 2009 for the Company) and interim periods within those years, with earlier adoption

prohibited. We are evaluating the impact that the adoption of SFAS 141(R) will have on our consolidated

financial position, cash flows or results of operations.

74