2K Sports 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

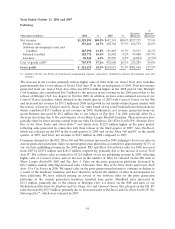

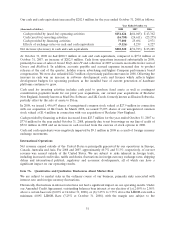

Our cash and cash equivalents increased by $202.5 million for the year ended October 31, 2008 as follows:

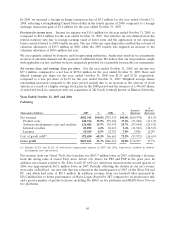

Year Ended October 31,

(thousands of dollars) 2008 2007 2006

Cash provided by (used for) operating activities $151,426 $(64,045) $ 43,362

Cash (used for) investing activities (16,780) (24,611) (25,275)

Cash provided by financing activities 77,000 25,694 2,971

Effects of exchange rates on cash and cash equivalents (9,126) 8,239 4,227

Net increase (decrease) in cash and cash equivalents $202,520 $(54,723) $ 25,285

At October 31, 2008 we had $280.3 million of cash and cash equivalents, compared to $77.8 million at

October 31, 2007, an increase of $202.5 million. Cash from operations increased substantially in 2008,

primarily because of sales of Grand Theft Auto IV and collection of 2007 accounts receivable from Carnival

Games and BioShock. In addition, accounts payable and accrued expenses increased due to product

releases at the end of the quarter, holiday season advertising and higher Company performance based

compensation. We were also refunded $22.3 million of previously paid income taxes in 2008. Offsetting the

increase in cash was an increase in software development costs and licenses which reflects higher

development budgets for upcoming products as the installed base of current generation of hardware

platforms continues to grow.

Cash used for investing activities includes cash paid to purchase fixed assets as well as contingent

consideration payments made for our prior year acquisitions, our current year acquisitions of Rockstar

New England, formerly known as Mad Doc Software, and 2K Czech, formerly known as Illusion Softworks,

partially offset by the sale of assets to Ditan.

In 2008, we issued 1,496,647 shares of unregistered common stock valued at $27.9 million in connection

with our acquisition of 2K Czech. In March 2008, we issued 53,033 shares of our unregistered common

stock valued at $1.4 million in connection with our acquisition of Rockstar New England.

Cash provided by financing activities increased from $25.7 million for the year ended October 31, 2007 to

$77.0 million for the year ended October 31, 2008, primarily due to net borrowings on our line of credit of

$52.0 million in 2008 and an increase in cash received from the exercise of stock options in 2008.

Cash and cash equivalents were negatively impacted by $9.1 million in 2008 as a result of foreign currency

exchange movements.

International Operations

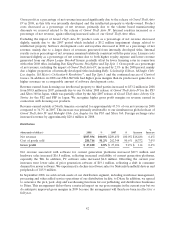

Net revenue earned outside of the United States is principally generated by our operations in Europe,

Canada, Australia and Asia. For 2008 and 2007, approximately 40.7% and 31.3%, respectively, of our net

revenue was earned outside of the United States. We are subject to risks inherent in foreign trade,

including increased credit risks, tariffs and duties, fluctuations in foreign currency exchange rates, shipping

delays and international political, regulatory and economic developments, all of which can have a

significant impact on our operating results.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We are subject to market risks in the ordinary course of our business, primarily risks associated with

interest rate and foreign currency fluctuations.

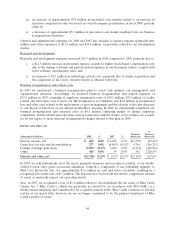

Historically, fluctuations in interest rates have not had a significant impact on our operating results. Under

our Amended Credit Agreement, outstanding balances bear interest at our election of (a) 2.00% to 2.50%

above a certain base rate (8.00% at October 31, 2008), or (b) 3.25% to 3.75% above the LIBOR rate with a

minimum 4.00% LIBOR Rate (7.25% at October 31, 2008), with the margin rate subject to the

51