2K Sports 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of $3,080. The disposition of Joytech did not involve a significant amount of assets or materially impact our

operating results.

Also, in 2007, we recognized a loss of $1,389 when we deconsolidated the net assets of Blue Castle

Games, Inc. (‘‘Blue Castle’’), which was previously accounted for, in accordance with FIN 46(R), as a

wholly-owned subsidiary and considered to be a variable interest entity. Blue Castle continues to develop

certain of our sports titles; however, we are no longer considered to be the primary beneficiary of Blue

Castle’s future profits or losses.

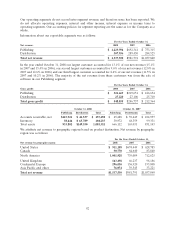

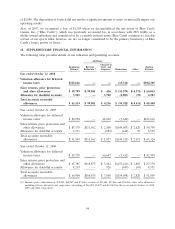

18. SUPPLEMENTARY FINANCIAL INFORMATION

The following table provides details of our valuation and qualifying accounts:

Additions

Charged to

Beginning Revenue Costs and Ending

Balance Reduction(1) Expenses Deductions Other Balance

Year ended October 31, 2008

Valuation allowance for deferred

income taxes $123,616 — — (19,311) — $104,305

Sales returns, price protection

and other allowances $ 59,799 $ 99,801 $ 416 $ (91,579) $(4,372) $ 64,065

Allowance for doubtful accounts 3,525 — 3,720 (2,803) (59) 4,383

Total accounts receivable

allowances $ 63,324 $ 99,801 $ 4,136 $ (94,382) $(4,431) $ 68,448

Year ended October 31, 2007

Valuation allowance for deferred

income taxes $ 82,994 — 44,262 (3,640) — $123,616

Sales returns, price protection and

other allowances $ 87,178 $111,562 $ 2,500 $(144,067) $ 2,626 $ 59,799

Allowance for doubtful accounts 4,331 — (683) (148) 25 3,525

Total accounts receivable

allowances $ 91,509 $111,562 $ 1,817 $(144,215) $ 2,651 $ 63,324

Year ended October 31, 2006

Valuation allowance for deferred

income taxes $ 19,759 — 66,647 (3,412) — $ 82,994

Sales returns, price protection and

other allowances $ 65,785 $168,875 $ 3,042 $(153,411) $ 2,887 $ 87,178

Allowance for doubtful accounts 4,119 — 926 (647) (67) 4,331

Total accounts receivable

allowances $ 69,904 $168,875 $ 3,968 $(154,058) $ 2,820 $ 91,509

(1) Includes price concessions of $52,269, $68,067 and $73,861; returns of $31,480, $37,616 and $54,004; other sales allowances

including rebates, discounts and cooperative advertising of $16,052, $5,879 and $41,010 for the years ended October 31, 2008,

2007 and 2006, respectively.

94