2K Sports 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

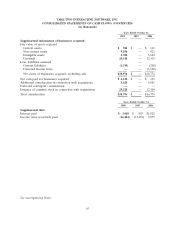

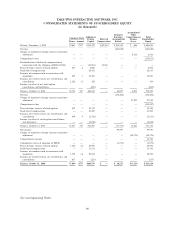

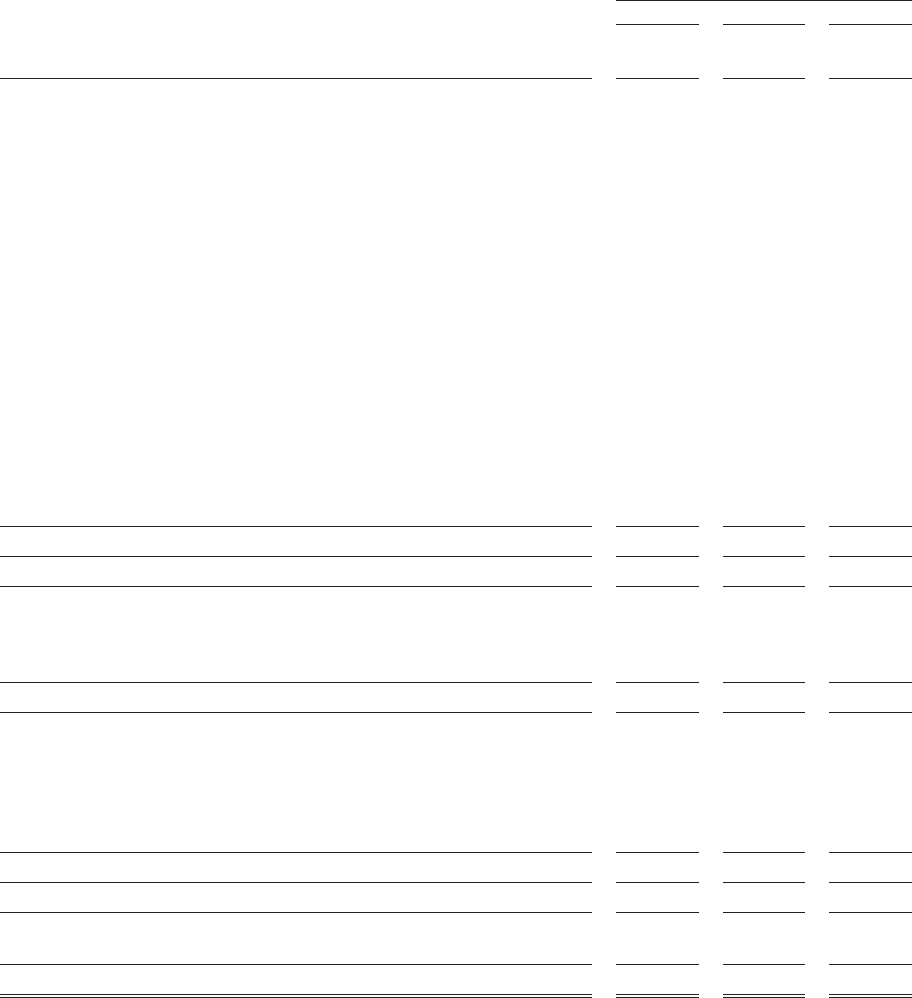

TAKE-TWO INTERACTIVE SOFTWARE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the Years Ended October 31,

2008 2007 2006

Operating activities:

Net income (loss) $ 97,097 $(138,406) $(184,889)

Adjustments to reconcile net income (loss) to net cash provided

by (used for) operating activities:

Amortization and write-off of software development costs and

licenses 146,102 106,675 146,569

Depreciation and amortization of long-lived assets 25,755 27,449 26,399

Impairment of goodwill and long-lived assets —— 15,608

Amortization and write-off of intellectual property 2,350 8,626 10,500

Stock-based compensation 40,387 17,329 21,931

Provision (benefit) for deferred income taxes (391) (1,718) 17,360

Loss on disposal of fixed assets 1,306 ——

Foreign currency transaction loss (gain) and other 5,659 (1,656) (2,070)

(Gain) loss on sale and deconsolidation (277) 4,469 —

Changes in assets and liabilities, net of effect from purchases

and disposal of businesses:

Accounts receivable, net (52,421) 39,159 56,651

Inventory (4,904) (10,203) 40,707

Software development costs and licenses (157,076) (160,643) (141,985)

Prepaid expenses, other current and other non-current assets 16,831 18,270 (30,086)

Accounts payable, accrued expenses, deferred revenue and

other liabilities 31,008 26,604 66,667

Total adjustments 54,329 74,361 228,251

Net cash provided by (used for) operating activities 151,426 (64,045) 43,362

Investing activities:

Purchase of fixed assets (12,277) (21,594) (25,084)

Cash received from sale of business 3,000 2,778 —

Payments for purchases of businesses, net of cash acquired (7,503) (5,795) (191)

Net cash used for investing activities (16,780) (24,611) (25,275)

Financing activities:

Proceeds from exercise of options 25,962 9,503 2,808

Borrowings on line of credit 135,000 18,000 —

Payments on line of credit (83,000) ——

Payment of debt issuance costs (962) (1,809) —

Excess tax benefit on exercise of stock options —— 163

Net cash provided by financing activities 77,000 25,694 2,971

Effects of exchange rates on cash and cash equivalents (9,126) 8,239 4,227

Net increase (decrease) in cash and cash equivalents 202,520 (54,723) 25,285

Cash and cash equivalents, beginning of year 77,757 132,480 107,195

Cash and cash equivalents, end of year $ 280,277 $ 77,757 $ 132,480

See accompanying Notes.

64