2K Sports 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Significant management judgments and estimates must be made and used in connection with establishing

the allowance for returns and price concessions in any accounting period. We believe we can make reliable

estimates of returns and price concessions. However, actual results may differ from initial estimates as a

result of changes in circumstances, market conditions and assumptions. Adjustments to estimates are

recorded in the period in which they become known.

Consideration Given to Customers and Received from Vendors

We have various marketing arrangements with retailers and distributors of our products that provide for

cooperative advertising and market development funds, among others, which are generally based on single

exchange transactions. Such amounts are accrued as a reduction to revenue at the later of: (1) The date at

which the related revenue is recognized by the vendor, or (2) the date at which the sales incentive is

offered, except for cooperative advertising which is included in selling and marketing expense if there is a

separate identifiable benefit and the benefit’s fair value can be established.

We receive various incentives from our manufacturers, including up-front cash payments as well as rebates

based on a cumulative level of purchases. Such amounts are generally accounted for as a reduction in the

price of the manufacturer’s product and included as a reduction of inventory or cost of goods sold, based

on (1) a ratio of current period revenue to the total revenue expected to be recorded over the remaining

life of the product or (2) an agreed upon per unit rebate, based on actual units manufactured during the

period.

Advertising

We expense advertising costs as incurred. Advertising expense for the years ended October 31, 2008, 2007,

and 2006 amounted to $101,374, $78,004 and $83,533, respectively.

Earnings (Loss) per Share

Basic earnings per share (‘‘EPS’’) is computed by dividing the net income (loss) applicable to common

stockholders for the period by the weighted average number of shares of common stock outstanding during

the same period. Diluted EPS is computed by dividing the net income applicable to common stockholders

for the period by the weighted average number of shares of common stock outstanding and common stock

equivalents, which includes shares of common stock issuable upon the exercise of stock options, restricted

stock and warrants outstanding during the same period. The computation for diluted number of shares

excludes those unexercised stock options and warrants, which are antidilutive. For the years ended

October 31, 2007 and 2006, all common stock equivalents were excluded from our computation of diluted

weighted average shares outstanding because their effect would have been antidilutive due to the net loss

for those periods. The number of antidilutive common stock equivalents excluded was approximately

3,651,000, 5,624,000 and 7,208,000 for the years ended October 31, 2008, 2007 and 2006, respectively.

In addition, for the year ended October 31, 2008, we have excluded from our diluted earnings per share

calculations 900,000 shares of market based restricted stock awarded to ZelnickMedia Corporation

(‘‘ZelnickMedia’’) because the issuance of such shares is subject to the achievement of certain

performance obligations. See Note 15 of the Notes to Consolidated Financial Statements for further

information regarding ZelnickMedia restricted stock awards.

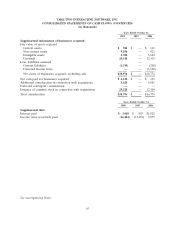

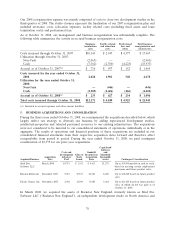

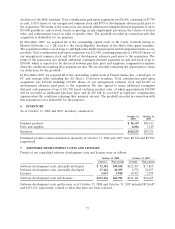

Years ended October 31,

(thousands of shares) 2008 2007 2006

Basic shares 75,039 71,860 71,012

Dilutive effect of equity incentive plans 904 ——

Diluted shares 75,943 71,860 71,012

72