2K Sports 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.financial guidance falling below our expectations and analysts’ and investors’ expectations, to factors

affecting the computer, software, entertainment, media or electronics industries, or to national or

international economic conditions.

Stock markets, in general, have experienced over the years, and continue to experience, significant price

and volume fluctuations that have affected market prices for companies such as ours and that may be

unrelated or disproportionate to the operating performance of the affected companies. These broad

market and industry fluctuations may adversely affect the price of our stock, regardless of our operating

performance.

We face risks from our international operations.

We are subject to certain risks because of our international operations, particularly as we seek to grow our

business and presence outside of the United States. Changes to and compliance with a variety of foreign

laws and regulations may increase our cost of doing business and our inability or failure to obtain required

approvals could harm our international and domestic sales. Trade legislation in either the United States or

other countries, such as a change in the current tariff structures, import/export compliance laws or other

trade laws or policies, could adversely affect our ability to sell or to distribute in international markets. We

incur additional legal compliance costs associated with our international operations and could become

subject to legal penalties in foreign countries if we do not comply with local laws and regulations which

may be substantially different from those in the United States. In many foreign countries, particularly in

those with developing economies, it may be common to engage in business practices that are prohibited by

United States laws and regulations, such as the Foreign Corrupt Practices Act, and by local laws, such as

laws prohibiting corrupt payments to government officials. Although we implement policies and

procedures designed to ensure compliance with these laws, there can be no assurance that all of our

employees, contractors and agents, as well as those companies to which we outsource certain of our

business operations, including those based in or from countries where practices which violate such laws

may be customary, will not take actions in violation of our policies. Any such violation, even if prohibited

by our policies, could have a material adverse effect on our business.

Our reported financial results could be adversely affected by the application of existing or future accounting

standards to our business as it evolves.

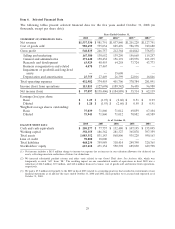

The frequency of accounting policy changes may continue to accelerate. For example, standards regarding

software revenue recognition have and could further significantly affect the way we account for revenue

related to our products and services. We expect that a significant portion of our games will be online-

enabled in the future, and we could be required to recognize the related revenue over an extended period

of time rather than at the time of sale. As we enhance, expand and diversify our business and product

offerings, the application of existing or future financial accounting standards, particularly those relating to

the way we account for revenue, could have a significant adverse effect on our reported results although

not necessarily on our cash flows.

Due to recent economic turmoil and a general depression in stock prices, we could become the target of an

unsolicited offer to acquire our shares of common stock. An unsolicited offer could create volatility in our

stock price, could create a distraction for our management and employees, and could cause uncertainty that

may adversely affect our business.

Due to significant price and volume fluctuations in the stock markets recently, we may become an

attractive target for an unsolicited bid for shares of our common stock. An unsolicited bid for shares of our

common stock would be a distraction for our management and employees, and require the expenditure of

significant time and resources by us and could cause our stock price to fluctuate significantly. An

unsolicited bid could also adversely impact our ability to recruit and retain employees and our ability to

enter into agreements with potential business partners. For example, in 2008, Electronic Arts Inc. (‘‘EA’’)

22