2K Sports 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

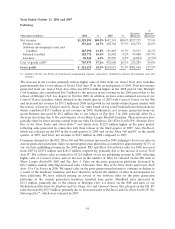

price points than their predecessor products. In addition, sales of hardware increased $7.9 million, or 8.4%,

due to the introduction of the PS3 and Wii systems. The increase in net revenue was partially offset by a

decrease in prior generation software sales of $14.8 million in 2007 as a result of the continued decline in

sales volume and average selling price of value and frontline software titles as the gaming industry

transitions to current generation platforms. In addition, we experienced a decline in sales of our PC

products of $10.0 million, or 18.5%. Foreign currency exchange rates increased net revenue by

approximately $2.8 million in 2007. Gross profit margins remained relatively consistent compared to the

prior year.

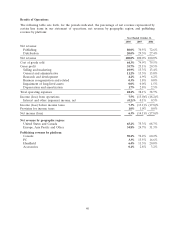

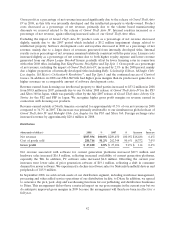

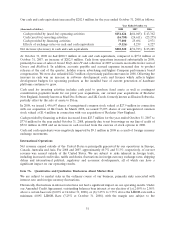

Operating Expenses

%

% of net % of net Increase/ Increase/

(thousands of dollars) 2007 revenue 2006 revenue (decrease) (decrease)

Selling and marketing $130,652 13.3% $139,250 13.4% $ (8,598) (6.2)%

General and administrative 150,432 15.3% 156,191 15.0% (5,759) (3.7)%

Research and development 48,455 4.9% 64,258 6.2% (15,803) (24.6)%

Business reorganization and related 17,467 1.8% —0.0% 17,467 N/M

Impairment of long-lived assets — 0.0% 15,608 1.5% (15,608) N/M

Depreciation and amortization 27,449 2.8% 26,399 2.5% 1,050 4.0%

Total operating expenses(1) $374,455 38.1% $401,706 38.7% $(27,251) (6.8)%

(1) Includes stock-based compensation expense, which was allocated as follows:

2007 2006

Selling and marketing $1,232 $ 1,256

General and administrative 7,080 13,277

Research and development 3,735 6,135

Business reorganization and related 2,066 —

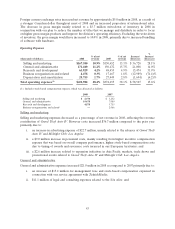

Selling and marketing

Selling and marketing expenses decreased $8.6 million in 2007 as compared to 2006 primarily due to:

i. $5.3 million more in marketing and promotion expenditures in 2006 mainly attributable to

advertising campaigns for our Grand Theft Auto products; and

ii. $2.5 million less in marketing at the annual E3 trade show event in 2007 as a result of the industry

wide downsizing of the event compared to past years.

General and administrative

General and administrative expenses decreased $5.8 million in 2007 as compared to 2006 primarily due to:

i. $6.2 million less in stock-based compensation expense, reflecting cost savings associated with the

departure of our former management team;

ii. approximately $2.8 million of cost savings in 2007 as a result of our 2006 studio closures, for

which we recorded $1.9 million of severance and lease termination expenses in 2006; and

iii. $2.3 million recorded in 2006 related to the relocation of our international publishing

headquarters to Geneva, Switzerland, partially offset by;

iv. higher expenses related to information technology system improvements of approximately

$2.6 million in 2007.

General and administrative expenses for 2007 and 2006 also includes occupancy expense (primarily rent,

utilities and office expenses) of $14.9 million and $15.2 million, respectively, related to our development

studios.

47