2K Sports 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

iii. an increase of approximately $3.4 million in personnel costs mainly related to an increase in

incentive compensation that was based on overall company performance in fiscal 2008; partially

offset by

iv. a decrease of approximately $5.3 million in personnel costs mainly resulting from our business

reorganization initiatives.

General and administrative expenses for 2008 and 2007 also includes occupancy expense (primarily rent,

utilities and office expenses) of $13.6 million and $14.9 million, respectively, related to our development

studios.

Research and development

Research and development expenses increased $15.5 million in 2008 compared to 2007 primarily due to:

i. a $12.3 million increase in personnel expense, mainly for higher stock-based compensation costs

due to the timing of awards and payroll-related expenses in our European studios, coupled with

lower software capitalization rates; and

ii. an increase of $2.1 million in technology related costs, primarily due to studio acquisitions and

the acquisition of 2K Czech, formerly known as Illusion Softworks.

Business reorganization and related costs

In 2007 we announced a business reorganization plan to renew and optimize our management and

organizational structure. Accordingly, we incurred business reorganization and related expenses of

$17.5 million in 2007 consisting of employee termination costs of $10.1 million, $2.9 million of facility

related and relocation costs to move our 2K headquarters to California, and $4.4 million in professional

fees and other costs related to the replacement of prior management and the election of five new directors

to our Board of Directors at our annual stockholders’ meeting. In 2008 we substantially completed our

business reorganization and incurred costs of $4.5 million consisting mainly of further employee

termination, facility related and relocation costs in connection with the closure of two studios. As a result,

we do not expect to incur material reorganization charges related to this plan in 2009.

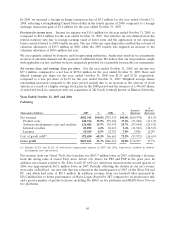

Interest and other, net

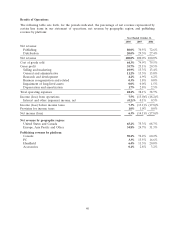

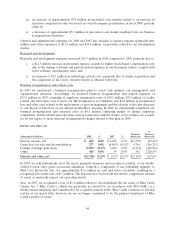

%

Increase/ Increase/

(thousands of dollars) 2008 % 2007 % (decrease) (decrease)

Interest income, net $ 695 0.0% $ 2,274 0.2% $(1,579) (69.4)%

Gain (loss) on sale and deconsolidation 277 0.0% (4,469) (0.5)% 4,746 (106.2)%

Foreign exchange gain (loss) (5,097) (0.3)% 1,644 0.2% (6,741) (410.0)%

Other 415 0.0% 34 0.0% 381 1120.6%

Interest and other, net $(3,710) (0.2)% $ (517) (0.1)% $(3,193) 617.6%

In 2007, we sold substantially all of the assets, primarily inventory and accounts receivable, of our wholly-

owned Joytech video game accessories subsidiary, formerly a component of our publishing segment, to

Mad Catz Interactive, Inc. for approximately $3.6 million in cash and notes receivable, resulting in a

recognized loss on the sale of $3.1 million. The disposition of Joytech did not involve a significant amount

of assets or materially impact our operating results.

Also, in 2007, we recognized a loss of $1.4 million when we deconsolidated the net assets of Blue Castle

Games, Inc. (‘‘Blue Castle’’), which was previously accounted for, in accordance with FIN 46(R), as a

wholly-owned subsidiary and considered to be a variable interest entity. Blue Castle continues to develop

certain of our sports titles; however, we are no longer considered to be the primary beneficiary of Blue

Castle’s profits or losses.

44