2K Sports 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

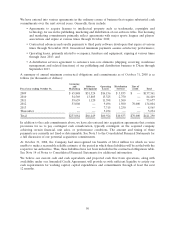

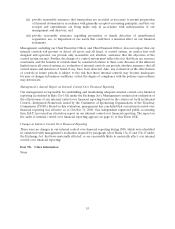

We have entered into various agreements in the ordinary course of business that require substantial cash

commitments over the next several years. Generally, these include:

• Agreements to acquire licenses to intellectual property such as trademarks, copyrights and

technology for use in the publishing, marketing and distribution of our software titles. Our licensing

and marketing commitments primarily reflect agreements with major sports leagues and players’

associations and expire at various times through October 2012;

• Contractual advances and royalty payments to third party software developers that expire at various

times through November 2010. Guaranteed minimum payments assume satisfactory performance;

• Operating leases, primarily related to occupancy, furniture and equipment, expiring at various times

through June 2015; and

• A distribution services agreement to outsource non-core elements (shipping, receiving, warehouse

management and related functions) of our publishing and distribution business to Ditan through

September 2013.

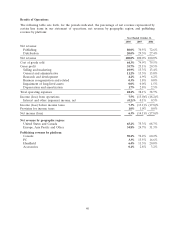

A summary of annual minimum contractual obligations and commitments as of October 31, 2008 is as

follows (in thousands of dollars):

Licensing

and Software Operating Distribution Line of

Fiscal year ending October 31, Marketing Development Leases Services credit Total

2009 $ 65,848 $51,524 $16,156 $ 3,833 $ — $137,361

2010 54,569 13,805 13,325 2,750 — 84,449

2011 59,659 1,120 11,398 1,500 — 73,677

2012 53,008 — 9,496 1,500 70,000 134,004

2013 — — 7,315 1,250 — 8,565

Thereafter — — 3,234 — — 3,234

Total $233,084 $66,449 $60,924 $10,833 $70,000 $441,290

In addition to the cash commitments above, we have also entered into acquisition agreements that contain

provisions for us to pay contingent cash consideration, typically contingent on the acquired company

achieving certain financial, unit sales, or performance conditions. The amount and timing of these

payments are currently not fixed or determinable. See Note 5 to the Consolidated Financial Statements for

a full discussion of our potential acquisition commitments.

At October 31, 2008, the Company had unrecognized tax benefits of $26.4 million for which we were

unable to make a reasonable reliable estimate of the period in which these liabilities will be settled with the

respective tax authorities. Thus, these liabilities have not been included in the contractual obligations table.

See Note 14 of Notes to Consolidated Financial Statements for additional information.

We believe our current cash and cash equivalents and projected cash flow from operations, along with

availability under our Amended Credit Agreement, will provide us with sufficient liquidity to satisfy our

cash requirements for working capital, capital expenditures and commitments through at least the next

12 months.

50