2K Sports 2008 Annual Report Download - page 48

Download and view the complete annual report

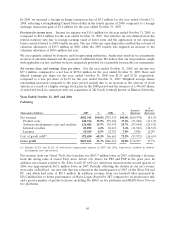

Please find page 48 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On November 1, 2007, we adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income

Taxes, an Interpretation of FASB Statement No. 109 (FIN 48). FIN 48 contains a two-step approach to

recognizing and measuring uncertain tax positions accounted for in accordance with FASB Statement

No. 109, Accounting for Income Taxes. The first step is to evaluate the tax position taken or expected to be

taken in a tax return by determining if the weight of available evidence indicates that it is more likely than

not that, on evaluation of the technical merits, the tax position will be sustained on audit, including

resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as

the largest amount that is more than 50% likely to be realized upon ultimate settlement. The cumulative

effect of adopting FIN 48 was $1.1 million, and was recorded to the opening balance of retained earnings.

At each period end, it is necessary for us to make certain estimates and assumptions to compute the

provision for income taxes including allocations of certain transactions to different tax jurisdictions,

amounts of permanent and temporary differences, the likelihood of deferred tax assets being recovered

and the outcome of contingent tax risks. These estimates and assumptions are revised as new events occur,

more experience is acquired and additional information is obtained. The impact of these revisions is

recorded in income tax expense or benefit in the period in which they become known.

Recently Issued Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (‘‘FASB’’) issued Statement of Financial

Accounting Standard (‘‘SFAS’’) No. 157, Fair Value Measurements (‘‘SFAS 157’’), which clarifies the

definition of fair value, establishes a framework for measuring fair value in generally accepted accounting

principles, and expands disclosures about fair value measurement. SFAS 157 does not require any new fair

value measurements and eliminates inconsistencies in guidance found in various prior accounting

pronouncements. SFAS 157 is effective for fiscal years beginning after November 15, 2007 (November 1,

2008 for the Company), and interim periods within those fiscal years. However, on February 12, 2008, the

FASB issued FASB Staff Position (‘‘FSP’’) FAS 157-2 which delays the effective date of SFAS 157 for all

nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in

the financial statements on a recurring basis (at least annually). This FSP partially defers the effective date

of SFAS 157 to fiscal years beginning after November 15, 2008 (November 1, 2009 for the Company), and

interim periods within those fiscal years for items within the scope of this FSP. On October 10, 2008 the

FASB issued FASB issued FSP FAS 157-3, Determining the Fair Value of a Financial Asset When the Market

for That Asset Is Not Active, which clarifies the application of SFAS 157, in a market that is not active. We

do not expect that the adoption of SFAS 157, FSP FAS 157-2 and FSP FAS 157-3 will have a material effect

on our consolidated financial position, cash flows or results of operations.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities (‘‘SFAS 159’’). SFAS 159 expands the use of fair value accounting but does not affect existing

standards, which require assets or liabilities to be carried at fair value. Under SFAS 159, a company may

elect to use fair value to measure certain financial assets and financial liabilities, on an

instrument-by-instrument basis. If the fair value option is elected, unrealized gains and losses on existing

items for which fair value has been elected are reported as a cumulative adjustment to beginning retained

earnings. Subsequent to the adoption of SFAS 159, changes in fair value are recognized in earnings.

SFAS 159 is effective for fiscal years beginning after November 15, 2007 (November 1, 2008 for the

Company), with earlier adoption permitted. We did not adopt SFAS 159 prior to November 1, 2008 and do

not expect it to have a material effect on our consolidated financial position, cash flows or results of

operations.

In June 2007, the FASB ratified the Emerging Issues Task Force’s (‘‘EITF’’) consensus conclusion on

EITF 07-03, Accounting for Nonrefundable Advance Payments for Goods or Services to Be Used in Future

Research and Development. EITF 07-03 addresses the diversity which exists with respect to the accounting

for the non-refundable portion of a payment made by a research and development entity for future

research and development activities. Under this conclusion, an entity is required to defer and capitalize

38