2K Sports 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In April 2008, the FASB issued FSP FAS 142-3, Determination of the Useful Life of Intangible Assets (‘‘FSP

FAS 142-3’’). FSP FAS 142-3 amends the factors an entity should consider in developing renewal or

extension assumptions used in determining the useful life of recognized intangible assets under SFAS

No. 142, Goodwill and Other Intangible Assets. This guidance for determining the useful life of a recognized

intangible asset applies prospectively to intangible assets acquired individually or with a group of other

assets in either an asset acquisition or business combination. FSP FAS 142-3 is effective for fiscal years, and

interim periods within those fiscal years, beginning after December 15, 2008 (November 1, 2009 for the

Company), and early adoption is prohibited. We do not expect that the adoption of FSP FAS 142-3 will

have a material effect on our consolidated financial position, cash flows or results of operations.

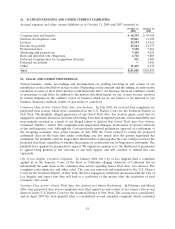

In June 2008, the FASB issued Staff Position EITF 03-6-1, Determining Whether Instruments Granted in

Share-Based Payment Transactions Are Participating Securities (‘‘FSP EITF 03-6-1’’), which is effective for

financial statements issued for fiscal years beginning after December 15, 2008. FSP EITF 03-6-1 clarifies

that share-based payment awards that entitle holders to receive nonforfeitable dividends before they vest

will be considered participating securities and included in the basic earnings per share calculation. The

Company is assessing the impact of adoption of FSP EITF 03-6-1 on its results of operations.

2. RECENT DEVELOPMENTS

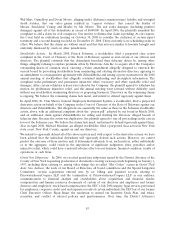

During the year ended October 31, 2008, Electronic Arts Inc. (‘‘EA’’) extended a tender offer to our

stockholders (the ‘‘Offer’’) to acquire all outstanding shares of our Common Stock. Our Board of

Directors, upon the advice of its financial and legal advisors, unanimously determined that the Offer was

inadequate and recommended that stockholders not accept it. The Offer was extended several times

through August 2008, at which time the Offer expired. Our management and Board commenced a formal

process to review strategic alternatives beginning in April 2008 that included discussions with potential

interested parties. In October 2008, we announced the conclusion of our strategic review process. We

incurred $11,070 of costs in 2008 related to the EA Offer and our strategic review process which are

recorded in general and administrative expenses.

3. MANAGEMENT AGREEMENT

In March 2007, we began operating under a management services agreement with ZelnickMedia (the

‘‘Management Agreement’’), whereby ZelnickMedia provides us with certain management, consulting and

executive level services. Strauss Zelnick, the President of ZelnickMedia, serves as our Executive Chairman.

In addition, we have entered into employment agreements with Ben Feder and Karl Slatoff to serve as our

Chief Executive Officer and Executive Vice President, respectively. Both Mr. Feder and Mr. Slatoff are

partners of ZelnickMedia. The Management Agreement expires in October 2012 and provides for an

annual management fee of $2,500 ($750 prior to the amendment that was effective as of April 1, 2008) and

a maximum bonus of $2,500 per fiscal year ($750 prior to the amendment that was effective as of April 1,

2008) based on the Company achieving certain performance thresholds. In consideration for

ZelnickMedia’s services under the Management Agreement, we recorded consulting expense (a

component of general and administrative expenses) of $3,674 and $649 for the years ended October 31,

2008 and 2007, respectively.

Pursuant to the Management Agreement, we also issued stock-based compensation to ZelnickMedia. See

Note 15 for a discussion of the such awards.

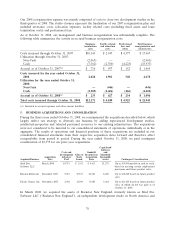

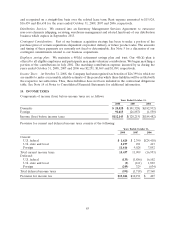

4. BUSINESS REORGANIZATION AND RELATED CHARGES

We initiated a management and business reorganization plan in the second quarter of 2007, which included

costs to replace our former executive management team and certain members of our Board of Directors,

and utilize the services of ZelnickMedia. In addition, we undertook a restructuring plan that centralized

and eliminated certain of our business operations. As a result, we incurred employee termination costs,

relocation expenses, facility related costs (including fixed assets and lease termination costs) and

professional fees.

75