2K Sports 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

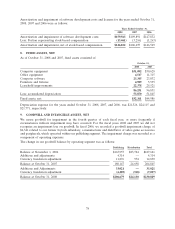

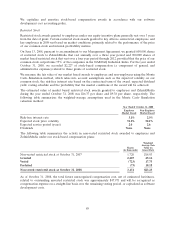

and recognized on a straight-line basis over the related lease term. Rent expense amounted to $15,924,

$16,459 and $16,658 for the years ended October 31, 2008, 2007 and 2006, respectively.

Distribution Services: We entered into an Inventory Management Services Agreement to outsource

non-core elements (shipping, receiving, warehouse management and related functions) of our distribution

business which expires in September 2013.

Contingent Consideration: Part of our business acquisition strategy has been to make a portion of the

purchase price of certain acquisitions dependent on product delivery or future product sales. The amounts

and timing of these payments are currently not fixed or determinable. See Note 5 for a discussion of our

contingent commitments related to our business acquisitions.

Employee savings plan: We maintain a 401(k) retirement savings plan and trust. Our 401(k) plan is

offered to all eligible employees and participants may make voluntary contributions. We began matching a

portion of the contributions in July 2002. The matching contribution expense incurred by us during the

years ended October 31, 2008, 2007 and 2006 was $2,251, $1,869 and $1,989, respectively.

Income Taxes: At October 31, 2008, the Company had unrecognized tax benefits of $26,399 for which we

are unable to make a reasonable reliable estimate of the period in which these liabilities will be settled with

the respective tax authorities. Thus, these liabilities have not been included in the contractual obligations

table. See Note 14 of Notes to Consolidated Financial Statements for additional information.

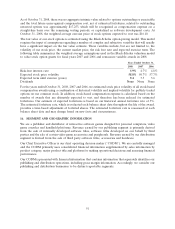

14. INCOME TAXES

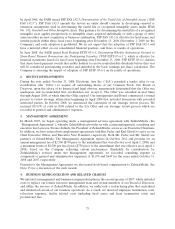

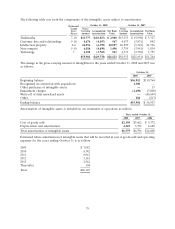

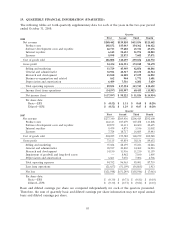

Components of income (loss) before income taxes are as follows:

Years Ended October 31,

2008 2007 2006

Domestic $ 20,528 $(101,328) $(182,932)

Foreign 91,615 (26,887) (1,550)

Income (loss) before income taxes $112,143 $(128,215) $(184,482)

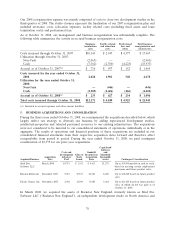

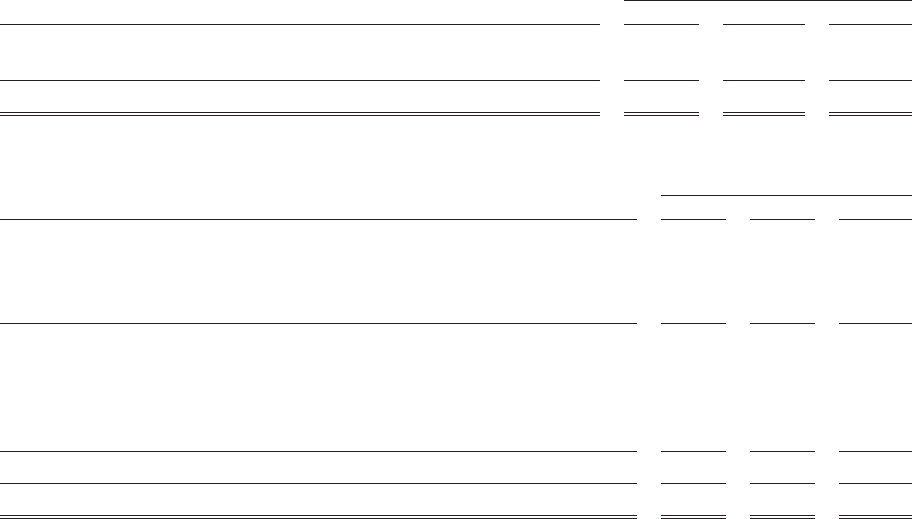

Provision for current and deferred income taxes consists of the following:

Years Ended October 31,

2008 2007 2006

Current:

U.S. federal $ 1,624 $ 2,390 $(24,418)

U.S. state and local 2,197 491 413

Foreign 11,616 9,028 7,052

Total current income taxes 15,437 11,909 (16,953)

Deferred:

U.S. federal (133) (1,886) 16,102

U.S. state and local (9) (161) 1,892

Foreign (249) 329 (634)

Total deferred income taxes (391) (1,718) 17,360

Provision for income tax $15,046 $10,191 $ 407

85