2K Sports 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116

|

|

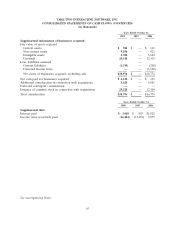

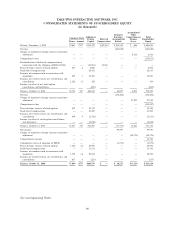

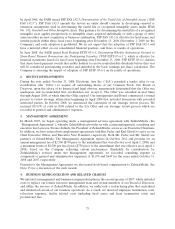

TAKE-TWO INTERACTIVE SOFTWARE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

(in thousands)

Years Ended October 31,

2008 2007 2006

Supplemental information of businesses acquired:

Fair value of assets acquired

Current assets $ 381 $ — $ 112

Non-current assets 9,296 — 421

Intangible assets 1,300 — 5,644

Goodwill 29,518 — 12,419

Less, liabilities assumed —

Current liabilities (1,519) — (200)

Deferred income taxes —— (1,620)

Net assets of businesses acquired, excluding cash $38,976 $ — $16,776

Net cash paid for businesses acquired $ 4,128 $ — $ 191

Additional consideration in connection with acquisitions 5,620 — 4,085

Deferred contingent consideration ———

Issuance of common stock in connection with acquisitions 29,228 — 12,500

Total consideration $38,976 $ — $16,776

Years Ended October 31,

2008 2007 2006

Supplemental data:

Interest paid $ 3,018 $ 895 $1,028

Income taxes (received) paid (16,484) (13,439) 9,875

See accompanying Notes.

65