PNC Bank 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

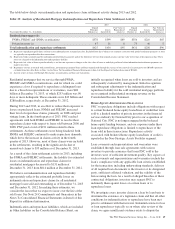

with the Agency securitizations, most sale agreements do not

provide for penalties or other remedies if we do not respond

timely to investor indemnification or repurchase requests.

Indemnification and repurchase claims are often settled on an

individual basis through make-whole payments or loan

repurchases, although we may also negotiate pooled

settlements with investors. In connection with pooled

settlements, we typically do not repurchase loans and the

consummation of such transactions generally results in us no

longer having indemnification and repurchase exposure with

the investor in the transaction.

For the first and second-lien mortgage settled claims

contained in the table below, a significant amount of these

claims were associated with sold loans originated through

correspondent lender and broker origination channels. In

certain instances when indemnification or repurchase claims

are settled for these types of sold loans, we have recourse back

to the correspondent lenders, brokers and other third-parties

(e.g., contract underwriting companies, closing agents,

appraisers, etc.). Depending on the underlying reason for the

investor claim, we determine our ability to pursue recourse

with these parties and file claims with them accordingly. Our

historical recourse recovery rate has been insignificant as our

efforts have been impacted by the inability of such parties to

reimburse us for their recourse obligations (e.g., their capital

availability or whether they remain in business) or factors that

limit our ability to pursue recourse from these parties (e.g.,

contractual loss caps, statutes of limitations).

Origination and sale of residential mortgages is an ongoing

business activity and, accordingly, management continually

assesses the need to recognize indemnification and repurchase

liabilities pursuant to the associated investor sale agreements.

We establish indemnification and repurchase liabilities for

estimated losses on sold first and second-lien mortgages for

which indemnification is expected to be provided or for loans

that are expected to be repurchased. For the first and second-

lien mortgage sold portfolio, we have established an

indemnification and repurchase liability pursuant to investor

sale agreements based on claims made and our estimate of

future claims on a loan by loan basis. To estimate the

mortgage repurchase liability arising from breaches of

representations and warranties, we consider the following

factors: (i) borrower performance in our historically sold

portfolio (both actual and estimated future defaults), (ii) the

level of outstanding unresolved repurchase claims,

(iii) estimated probable future repurchase claims, considering

information about file requests, delinquent and liquidated

loans, resolved and unresolved mortgage insurance rescission

notices and our historical experience with claim rescissions,

(iv) the potential ability to cure the defects identified in the

repurchase claims (“rescission rate”) and (v) the estimated

severity of loss upon repurchase of the loan or collateral,

make-whole settlement or indemnification.

See Note 24 Commitments and Guarantees in the Notes To

Consolidated Financial Statements in Item 8 of this Report for

additional information.

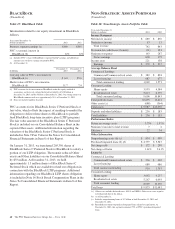

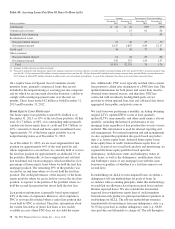

The following tables present the unpaid principal balance of repurchase claims by vintage and total unresolved repurchase claims

for the past five quarters.

Table 30: Analysis of Quarterly Residential Mortgage Repurchase Claims by Vintage

Dollars in millions

December 31

2013

September 30

2013

June 30

2013

March 31

2013

December 31

2012

2004 & Prior $ 66 $ 41 $ 51 $ 12 $ 11

2005 88 48 7 10 8

2006 27 27 19 28 23

2007 35 58 36 108 45

2008 979157

2008 & Prior 225 181 122 173 94

2009 – 2013 19 16 14 50 38

Total $244 $197 $136 $223 $132

FNMA, FHLMC and GNMA % 96% 90% 92% 95% 94%

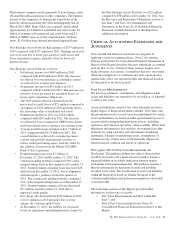

Table 31: Analysis of Quarterly Residential Mortgage Unresolved Asserted Indemnification and Repurchase Claims

Dollars in millions

December 31

2013

September 30

2013

June 30

2013

March 31

2013

December 31

2012

FNMA, FHLMC and GNMA Securitizations $13 $148 $ 96 $165 $290

Private Investors (a) 22 24 37 45 47

Total unresolved claims $35 $172 $133 $210 $337

FNMA, FHLMC and GNMA % 37% 86% 72% 79% 86%

(a) Activity relates to loans sold through Non-Agency securitization and loan sale transactions.

68 The PNC Financial Services Group, Inc. – Form 10-K