PNC Bank 2013 Annual Report Download - page 142

Download and view the complete annual report

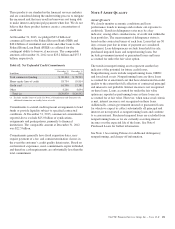

Please find page 142 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In February 2013, the FASB issued ASU 2013-02,

Comprehensive Income (Topic 220): Reporting of Amounts

Reclassified Out of Accumulated Other Comprehensive

Income. This ASU requires companies to present information

about reclassification adjustments from Accumulated other

comprehensive income in a single note or on the face of the

financial statements. Additionally, companies are to disclose

by component reclassifications out of Accumulated other

comprehensive income and their effects on the respective line

items on net income and other disclosures currently required

under U.S. GAAP. ASU 2013-02 was effective for annual and

interim reporting periods beginning after December 15, 2012.

These required disclosures are included in Note 20 Other

Comprehensive Income.

In December 2011, the FASB issued ASU 2011-11, Balance

Sheet (Topic 210): Disclosures about Offsetting Assets and

Liabilities and then amended the scope of ASU 2011-11 in

January 2013 through the issuance of ASU 2013-01, Balance

Sheet (Topic 210): Clarifying the Scope of Disclosures about

Offsetting Assets and Liabilities. This ASU applies to all

entities that have derivative instruments, repurchase

agreements and reverse repurchase agreements, or securities

lending agreements that are (i) offset in accordance with ASC

210-20-45 or ASC 815-10-45 or (ii) subject to an enforceable

master netting arrangement or similar agreement, and requires

an entity to disclose information about offsetting to enable

users of its financial statements to understand the effect of

those arrangements on its financial position. The disclosures

were required for quarterly and annual reporting periods

beginning on or after January 1, 2013 and were to be applied

retrospectively for all comparative periods presented. We

adopted these ASUs on January 1, 2013 for our derivatives

that we offset in accordance with ASC 815-10-45 and for our

repurchase/resale arrangements under enforceable master

netting arrangements, which we do not currently offset on our

Consolidated Balance Sheet. These ASUs did not change the

accounting for these arrangements or require them to be offset

and thus had no impact on our results of operation or financial

position. These disclosures are included in Note 17 Financial

Derivatives and Note 24 Commitments and Guarantees.

In December 2011, the FASB issued ASU 2011-10, Property,

Plant, and Equipment (Topic 360): Derecognition of in

Substance Real Estate – a Scope Clarification (a consensus of

the FASB Emerging Issues Task Force). This ASU clarified

that the guidance in ASC 360-20 applies to a parent that

ceases to have a controlling financial interest (as described in

ASC 810-10) in a subsidiary that is in substance real estate as

a result of default on the subsidiary’s nonrecourse debt. ASU

2011-10 should be applied on a prospective basis and was

effective for fiscal years, and interim periods within those

years, beginning on or after June 15, 2012. We adopted ASU

2011-10 on January 1, 2013 and there was no impact to our

results of operations or financial position.

In October 2012, the FASB issued ASU 2012-06, Business

Combinations (Topic 805): Subsequent Accounting for an

Indemnification Asset Recognized at the Acquisition Date as a

Result of a Government-Assisted Acquisition of a Financial

Institution. This ASU impacts all entities that recognize an

indemnification asset in purchase accounting for a

government-assisted acquisition of a financial institution. The

effective date of ASU 2012-06 was January 1, 2013. We

adopted ASU 2012-06 on January 1, 2013 and there was no

impact to our results of operations or financial position.

In July 2012, the FASB issued ASU 2012-02, Intangibles –

Goodwill and Other (Topic 350): Testing Indefinite-Lived

Intangible Assets for Impairment. This ASU applies to

indefinite-lived intangible assets other than goodwill and

simplifies the impairment test of those assets by allowing an

entity to first assess qualitative factors to determine whether it

is more likely than not that the fair value of an indefinite lived

intangible asset is less than its carrying amount before

proceeding to the quantitative impairment test. The effective

date of this ASU was January 1, 2013. However, since we

currently do not have any indefinite lived intangibles other

than goodwill, this ASU did not have an effect on our results

of operations or financial position.

N

OTE

2A

CQUISITION AND

D

IVESTITURE

A

CTIVITY

2012 RBC B

ANK

(USA) A

CQUISITION

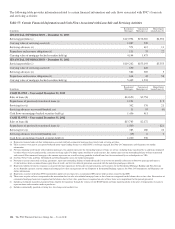

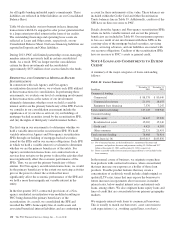

On March 2, 2012, PNC acquired 100% of the issued and

outstanding common stock of RBC Bank (USA), the U.S.

retail banking subsidiary of Royal Bank of Canada. As part of

the acquisition, PNC also purchased a credit card portfolio

from RBC Bank (Georgia), National Association. PNC paid

$3.6 billion in cash as consideration for the acquisition of both

RBC Bank (USA) and the credit card portfolio. The fair value

of the net assets acquired totaled approximately $2.6 billion,

including $18.1 billion of deposits, $14.5 billion of loans and

$.2 billion of other intangible assets. Goodwill of $1.0 billion

was recorded as part of the acquisition. Refer to Note 2

Acquisition and Divestiture Activity in Item 8 of our 2012

Form 10-K for additional details related to the RBC Bank

(USA) transactions.

2012 S

ALE

O

F

S

MARTSTREET

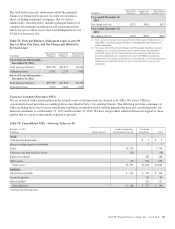

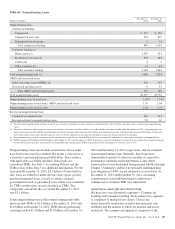

Effective October 26, 2012, PNC divested certain deposits and

assets of the Smartstreet business unit, which was acquired by

PNC as part of the RBC Bank (USA) acquisition, to Union

Bank, N.A. Smartstreet is a nationwide business focused on

homeowner or community association managers and had

approximately $1 billion of assets and deposits as of

September 30, 2012. The gain on sale was immaterial and

resulted in a reduction of goodwill and core deposit

intangibles by $46 million and $13 million, respectively.

Results from operations of Smartstreet from March 2, 2012

through October 26, 2012 are included in our Consolidated

Income Statement.

124 The PNC Financial Services Group, Inc. – Form 10-K