PNC Bank 2013 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

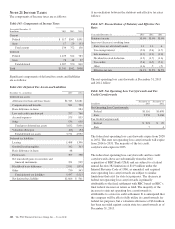

During 2013, PNC made an assertion under ASC 740 –

Income Taxes that the earnings of certain non-U.S.

subsidiaries were indefinitely reinvested. As of December 31,

2013, the company had approximately $46 million of earnings

and $39 million of foreign currency translation attributed to

foreign subsidiaries that have been indefinitely reinvested

abroad for which no incremental U.S. income tax provision

has been recorded. If a U.S. deferred tax liability were to be

recorded, the estimated tax liability on those undistributed

earnings and foreign currency translation would be

approximately $29 million.

Retained earnings at both December 31, 2013 and 2012

included $117 million in allocations for bad debt deductions

of former thrift subsidiaries for which no income tax has been

provided. Under current law, if certain subsidiaries use these

bad debt reserves for purposes other than to absorb bad debt

losses, they will be subject to Federal income tax at the

current corporate tax rate.

The Company had a liability for unrecognized tax benefits of

$110 million at December 31, 2013 and $176 million at

December 31, 2012. At December 31, 2013, $87 million of

unrecognized tax benefits, if recognized, would favorably

impact the effective income tax rate.

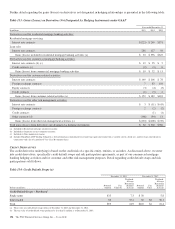

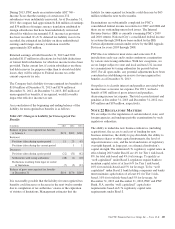

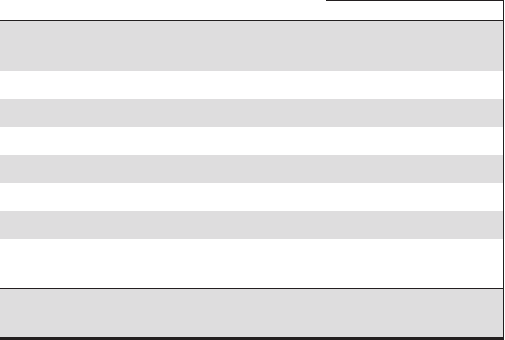

A reconciliation of the beginning and ending balance of the

liability for unrecognized tax benefits is as follows:

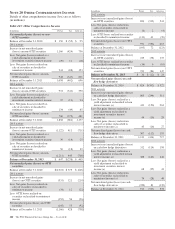

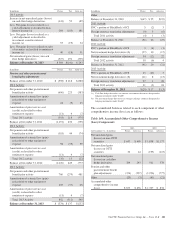

Table 149: Changes in Liability for Unrecognized Tax

Benefits

In millions 2013 2012 2011

Balance of gross unrecognized tax benefits

at January 1 $176 $209 $238

Increases:

Positions taken during a prior period 11 23 65

Positions taken during the current period 1 1

Decreases:

Positions taken during a prior period (22) (51) (62)

Settlements with taxing authorities (48) (1) (10)

Reductions resulting from lapse of statute

of limitations (7) (5) (23)

Balance of gross unrecognized tax benefits

at December 31 $110 $176 $209

It is reasonably possible that the liability for unrecognized tax

benefits could increase or decrease in the next twelve months

due to completion of tax authorities’ exams or the expiration

of statutes of limitations. Management estimates that the

liability for unrecognized tax benefits could decrease by $63

million within the next twelve months.

Examinations are substantially completed for PNC’s

consolidated federal income tax returns for 2007 and 2008 and

there are no outstanding unresolved issues. The Internal

Revenue Service (IRS) is currently examining PNC’s 2009

and 2010 returns. National City’s consolidated federal income

tax returns through 2008 have been audited by the IRS.

Certain adjustments remain under review by the IRS Appeals

Division for years 2003 through 2008.

PNC files tax returns in most states and some non-U.S.

jurisdictions each year and is under continuous examination

by various state taxing authorities. With few exceptions, we

are no longer subject to state and local and non-U.S. income

tax examinations by taxing authorities for periods before

2007. For all open audits, any potential adjustments have been

considered in establishing our reserve for unrecognized tax

benefits as of December 31, 2013.

Our policy is to classify interest and penalties associated with

income taxes as income tax expense. For 2013, we had a

benefit of $41 million of gross interest and penalties,

decreasing income tax expense. The total accrued interest and

penalties at December 31, 2013 and December 31, 2012 was

$45 million and $93 million, respectively.

N

OTE

22 R

EGULATORY

M

ATTERS

We are subject to the regulations of certain federal, state, and

foreign agencies and undergo periodic examinations by such

regulatory authorities.

The ability to undertake new business initiatives (including

acquisitions), the access to and cost of funding for new

business initiatives, the ability to pay dividends, the ability to

repurchase shares or other capital instruments, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in large part, on a financial institution’s

capital strength. The minimum U.S. regulatory capital ratios in

effect during 2013 under Basel I are 4% for Tier 1 risk-based,

8% for total risk-based and 4% for leverage. To qualify as

“well capitalized” under Basel I, regulators require banks to

maintain capital ratios of at least 6% for Tier 1 risk-based,

10% for total risk-based and 5% for leverage. To be “well

capitalized” under Basel I, bank holding companies and banks

must maintain capital ratios of at least 6% for Tier 1 risk-

based, 10% for total risk-based and 5% for leverage. At

December 31, 2013 and December 31, 2012, PNC and PNC

Bank, N.A. met the “well capitalized” capital ratio

requirements based on U.S. regulatory capital ratio

requirements under Basel I.

The PNC Financial Services Group, Inc. – Form 10-K 203