PNC Bank 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.N

OTE

3L

OAN

S

ALE AND

S

ERVICING

A

CTIVITIES

AND

V

ARIABLE

I

NTEREST

E

NTITIES

L

OAN

S

ALE AND

S

ERVICING

A

CTIVITIES

We have transferred residential and commercial mortgage

loans in securitization or sales transactions in which we have

continuing involvement. These transfers have occurred

through Agency securitization, Non-agency securitization, and

loan sale transactions. Agency securitizations consist of

securitization transactions with FNMA, FHLMC and

Government National Mortgage Association (GNMA)

(collectively the Agencies). FNMA and FHLMC generally

securitize our transferred loans into mortgage-backed

securities for sale into the secondary market through special

purpose entities (SPEs) that they sponsor. We, as an

authorized GNMA issuer/servicer, pool Federal Housing

Administration (FHA) and Department of Veterans Affairs

(VA) insured loans into mortgage-backed securities for sale

into the secondary market. In Non-agency securitizations, we

have transferred loans into securitization SPEs. In other

instances, third-party investors have also purchased our loans

in loan sale transactions and in certain instances have

subsequently sold these loans into securitization SPEs.

Securitization SPEs utilized in the Agency and Non-agency

securitization transactions are variable interest entities (VIEs).

Our continuing involvement in the FNMA, FHLMC, and

GNMA securitizations, Non-agency securitizations, and loan

sale transactions generally consists of servicing, repurchases

of previously transferred loans under certain conditions and

loss share arrangements, and, in limited circumstances,

holding of mortgage-backed securities issued by the

securitization SPEs.

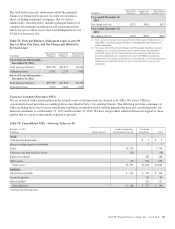

Depending on the transaction, we may act as the master,

primary, and/or special servicer to the securitization SPEs or

third-party investors. Servicing responsibilities typically

consist of collecting and remitting monthly borrower principal

and interest payments, maintaining escrow deposits,

performing loss mitigation and foreclosure activities, and, in

certain instances, funding of servicing advances. Servicing

advances, which are reimbursable, are recognized in Other

assets at cost and are made for principal and interest and

collateral protection.

We earn servicing and other ancillary fees for our role as

servicer and, depending on the contractual terms of the

servicing arrangement, we can be terminated as servicer with

or without cause. At the consummation date of each type of

loan transfer, we recognize a servicing right at fair value.

Servicing rights are recognized in Other intangible assets on

our Consolidated Balance Sheet and when subsequently

accounted for at fair value are classified within Level 3 of the

fair value hierarchy. See Note 9 Fair Value and Note 10

Goodwill and Other Intangible Assets for further discussion of

our residential and commercial servicing rights.

Certain loans transferred to the Agencies contain removal of

account provisions (ROAPs). Under these ROAPs, we hold an

option to repurchase at par individual delinquent loans that

meet certain criteria. When we have the unilateral ability to

repurchase a delinquent loan, effective control over the loan

has been regained and we recognize an asset (in either Loans

or Loans held for sale) and a corresponding liability (in Other

borrowed funds) on the balance sheet regardless of our intent

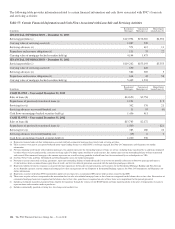

to repurchase the loan. At December 31, 2013 and

December 31, 2012, the balance of our ROAP asset and

liability totaled $128 million and $190 million, respectively.

The Agency and Non-agency mortgage-backed securities

issued by the securitization SPEs that are purchased and held

on our balance sheet are typically purchased in the secondary

market. PNC does not retain any credit risk on its Agency

mortgage-backed security positions as FNMA, FHLMC, and

the U.S. Government (for GNMA) guarantee losses of

principal and interest. Substantially all of the Non-agency

mortgage-backed securities acquired and held on our balance

sheet are senior tranches in the securitization structure.

We also have involvement with certain Agency and Non-

agency commercial securitization SPEs where we have not

transferred commercial mortgage loans. These SPEs were

sponsored by independent third-parties and the loans held by

these entities were purchased exclusively from other third-

parties. Generally, our involvement with these SPEs is as

servicer with servicing activities consistent with those

described above.

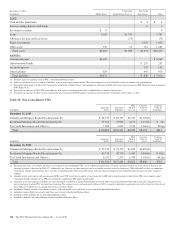

We recognize a liability for our loss exposure associated with

contractual obligations to repurchase previously transferred

loans due to breaches of representations and warranties and

also for loss sharing arrangements (recourse obligations) with

the Agencies. Other than providing temporary liquidity under

servicing advances and our loss exposure associated with our

repurchase and recourse obligations, we have not provided nor

are we required to provide any type of credit support,

guarantees, or commitments to the securitization SPEs or

third-party investors in these transactions. See Note 24

Commitments and Guarantees for further discussion of our

repurchase and recourse obligations.

The PNC Financial Services Group, Inc. – Form 10-K 125