PNC Bank 2013 Annual Report Download - page 152

Download and view the complete annual report

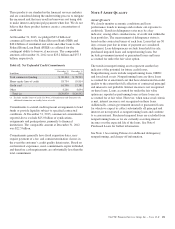

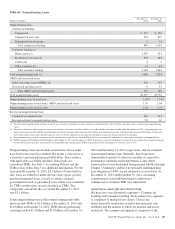

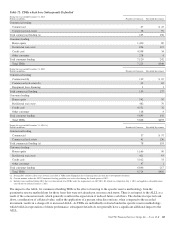

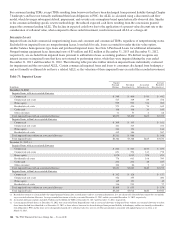

Please find page 152 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.commercial, commercial real estate, equipment lease

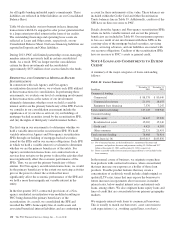

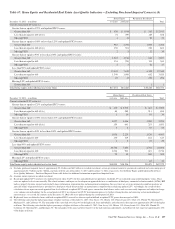

financing, and commercial purchased impaired loan classes.

The consumer segment is comprised of the home equity,

residential real estate, credit card, other consumer, and

consumer purchased impaired loan classes. Asset quality

indicators for each of these loan classes are discussed in more

detail below.

C

OMMERCIAL

L

ENDING

A

SSET

C

LASSES

C

OMMERCIAL

L

OAN

C

LASS

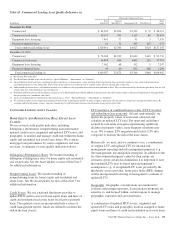

For commercial loans, we monitor the performance of the

borrower in a disciplined and regular manner based upon the

level of credit risk inherent in the loan. To evaluate the level

of credit risk, we assign an internal risk rating reflecting the

borrower’s PD and LGD. This two-dimensional credit risk

rating methodology provides granularity in the risk monitoring

process on an ongoing basis. These ratings are reviewed and

updated on a risk-adjusted basis, generally at least once per

year. Additionally, no less frequently than on an annual basis,

we update PD rates related to each rating grade based upon

internal historical data, augmented by market data. For small

balance homogenous pools of commercial loans, mortgages

and leases, we apply statistical modeling to assist in

determining the probability of default within these pools.

Further, on a periodic basis, we update our LGD estimates

associated with each rating grade based upon historical data.

The combination of the PD and LGD ratings assigned to a

commercial loan, capturing both the combination of

expectations of default and loss severity in event of default,

reflects the relative estimated likelihood of loss for that loan at

the reporting date. In general, loans with better PD and LGD

tend to have a lower likelihood of loss compared to loans with

worse PD and LGD, which tend to have a higher likelihood of

loss. The loss amount also considers exposure at date of

default, which we also periodically update based upon

historical data.

Based upon the amount of the lending arrangement and our

risk rating assessment, we follow a formal schedule of written

periodic review. On a quarterly basis, we conduct formal

reviews of a market’s or business unit’s entire loan portfolio,

focusing on those loans which we perceive to be of higher

risk, based upon PDs and LGDs, or loans for which credit

quality is weakening. If circumstances warrant, it is our

practice to review any customer obligation and its level of

credit risk more frequently. We attempt to proactively manage

our loans by using various procedures that are customized to

the risk of a given loan, including ongoing outreach, contact,

and assessment of obligor financial conditions, collateral

inspection and appraisal.

C

OMMERCIAL

R

EAL

E

STATE

L

OAN

C

LASS

We manage credit risk associated with our commercial real

estate projects and commercial mortgage activities similar to

commercial loans by analyzing PD and LGD. Additionally,

risks connected with commercial real estate projects and

commercial mortgage activities tend to be correlated to the

loan structure and collateral location, project progress and

business environment. As a result, these attributes are also

monitored and utilized in assessing credit risk.

As with the commercial class, a formal schedule of periodic

review is performed to also assess market/geographic risk and

business unit/industry risk. Often as a result of these

overviews, more in-depth reviews and increased scrutiny are

placed on areas of higher risk, including adverse changes in

risk ratings, deteriorating operating trends, and/or areas that

concern management. These reviews are designed to assess

risk and take actions to mitigate our exposure to such risks.

E

QUIPMENT

L

EASE

F

INANCING

L

OAN

C

LASS

We manage credit risk associated with our equipment lease

financing class similar to commercial loans by analyzing PD

and LGD.

Based upon the dollar amount of the lease and of the level of

credit risk, we follow a formal schedule of periodic review.

Generally, this occurs on a quarterly basis, although we have

established practices to review such credit risk more

frequently if circumstances warrant. Our review process

entails analysis of the following factors: equipment value/

residual value, exposure levels, jurisdiction risk, industry risk,

guarantor requirements, and regulatory compliance.

C

OMMERCIAL

P

URCHASED

I

MPAIRED

L

OAN

C

LASS

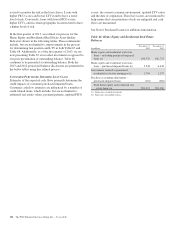

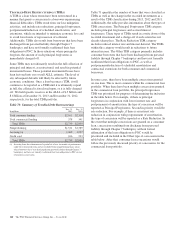

The credit impacts of purchased impaired loans are primarily

determined through the estimation of expected cash flows.

Commercial cash flow estimates are influenced by a number

of credit related items, which include but are not limited to:

estimated collateral value, receipt of additional collateral,

secondary trading prices, circumstances of possible and/or

ongoing liquidation, capital availability, business operations

and payment patterns.

We attempt to proactively manage these factors by using

various procedures that are customized to the risk of a given

loan. These procedures include a review by our Special Asset

Committee (SAC), ongoing outreach, contact, and assessment

of obligor financial conditions, collateral inspection and

appraisal.

See Note 6 Purchased Loans for additional information.

134 The PNC Financial Services Group, Inc. – Form 10-K