PNC Bank 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R

ETAIL

B

ANKING

(Unaudited)

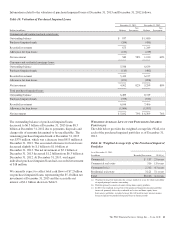

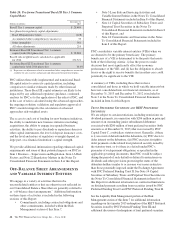

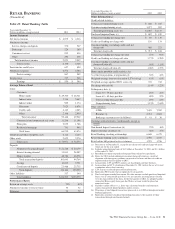

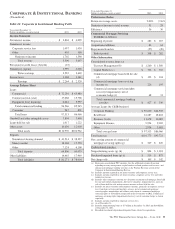

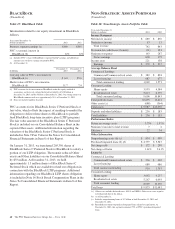

Table 23: Retail Banking Table

Year ended December 31

Dollars in millions, except as noted 2013 2012

Income Statement

Net interest income $ 4,079 $ 4,316

Noninterest income

Service charges on deposits 570 547

Brokerage 224 189

Consumer services 935 838

Other 292 438

Total noninterest income 2,021 2,012

Total revenue 6,100 6,328

Provision for credit losses 657 800

Noninterest expense 4,576 4,586

Pretax earnings 867 942

Income taxes 317 346

Earnings $ 550 $ 596

Average Balance Sheet

Loans

Consumer

Home equity $ 29,300 $ 28,321

Indirect auto 7,746 5,467

Indirect other 909 1,174

Education 7,923 8,878

Credit cards 4,142 4,063

Other 2,148 2,039

Total consumer 52,168 49,942

Commercial and commercial real estate 11,266 11,198

Floor plan 2,055 1,788

Residential mortgage 741 946

Total loans 66,230 63,874

Goodwill and other intangible assets 6,116 6,123

Other assets 2,625 2,576

Total assets $ 74,971 $ 72,573

Deposits

Noninterest-bearing demand $ 21,248 $ 20,179

Interest-bearing demand 31,811 28,007

Money market 48,784 46,578

Total transaction deposits 101,843 94,764

Savings 10,835 9,751

Certificates of deposit 21,488 25,715

Total deposits 134,166 130,230

Other liabilities 337 340

Total liabilities $134,503 $130,570

Performance Ratios

Return on average assets .73% .82%

Noninterest income to total revenue 33 32

Efficiency 75 72

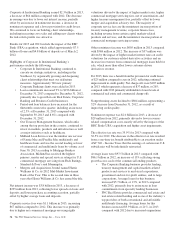

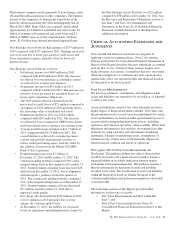

Year ended December 31

Dollars in millions, except as noted 2013 2012

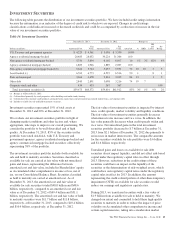

Other Information (a)

Credit-related statistics:

Commercial nonperforming assets $ 208 $ 245

Consumer nonperforming assets 1,077 902

Total nonperforming assets (b) $1,285 $1,147

Purchased impaired loans (c) $ 692 $ 819

Commercial lending net charge-offs $ 89 $ 119

Credit card lending net charge-offs 156 174

Consumer lending (excluding credit card) net

charge-offs 468 521

Total net charge-offs $ 713 $ 814

Commercial lending net charge-off ratio .67% .92%

Credit card lending net charge-off ratio 3.77% 4.28%

Consumer lending (excluding credit card) net

charge-off ratio (d) .96% 1.11%

Total net charge-off ratio (d) 1.08% 1.27%

Home equity portfolio credit statistics: (e)

% of first lien positions at origination (f) 52% 42%

Weighted-average loan-to-value ratios (LTVs) (f) (g) 81% 81%

Weighted-average updated FICO scores (h) 745 742

Net charge-off ratio (d) 1.14% 1.22%

Delinquency data: (i)

Loans 30 – 59 days past due .20% .42%

Loans 60 – 89 days past due .09% .22%

Total accruing loans past due .29% .64%

Nonperforming loans 3.15% 2.64%

Other statistics:

ATMs 7,445 7,282

Branches (j) 2,714 2,881

Brokerage account assets (in billions) $ 41 $ 38

Customer-related statistics: (in thousands, except as

noted)

Non-branch deposit transactions (k) 25% 16%

Digital consumer customers (l) 38% 35%

Retail Banking checking relationships 6,648 6,475

Retail online banking active customers 4,592 4,227

Retail online bill payment active customers 1,293 1,236

(a) Presented as of December 31, except for net charge-offs and net charge-off ratios,

which are for the year ended.

(b) Includes nonperforming loans of $1.2 billion at December 31, 2013 and $1.1 billion

at December 31, 2012.

(c) Recorded investment of purchased impaired loans related to acquisitions.

(d) Ratios for 2013 include additional consumer charge-offs taken as a result of

alignment with interagency guidance on practices for loans and lines of credit we

implemented in the first quarter of 2013.

(e) Lien position, LTV and FICO statistics are based upon customer balances.

(f) Lien position and LTV calculation at December 31, 2013 reflect the use of revised

assumptions where data is missing.

(g) LTV statistics are based upon current information.

(h) Represents FICO scores that are updated at least quarterly.

(i) Data based upon recorded investment. Past due amounts exclude purchased impaired

loans, even if contractually past due as we are currently accreting interest income

over the expected life of the loans. In the first quarter of 2012, we adopted a policy

stating that Home equity loans past due 90 days or more would be placed on

nonaccrual status.

(j) Excludes satellite offices (e.g., drive-ups, electronic branches and retirement

centers) that provide limited products and/or services.

(k) Percentage of total deposit transactions processed at an ATM or through our mobile

banking application.

(l) Represents consumer checking relationships that process the majority of their

transactions through non-branch channels.

The PNC Financial Services Group, Inc. – Form 10-K 51