PNC Bank 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P

URCHASED

I

MPAIRED

L

OANS

–A

CCRETABLE

D

IFFERENCE

S

ENSITIVITY

A

NALYSIS

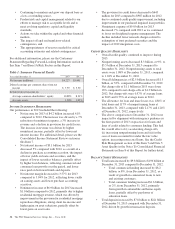

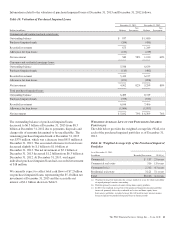

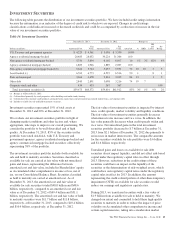

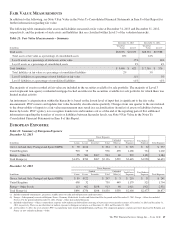

The following table provides a sensitivity analysis on the

Purchased Impaired Loans portfolio. The analysis reflects

hypothetical changes in key drivers for expected cash flows

over the life of the loans under declining and improving

conditions at a point in time. Any unusual significant

economic events or changes, as well as other variables not

considered below (e.g., natural or widespread disasters), could

result in impacts outside of the ranges represented below.

Additionally, commercial and commercial real estate loan

settlements or sales proceeds can vary widely from appraised

values due to a number of factors including, but not limited to,

special use considerations, liquidity premiums and

improvements/deterioration in other income sources.

Table 12: Accretable Difference Sensitivity – Total

Purchased Impaired Loans

In billions

December 31,

2013

Declining

Scenario (a)

Improving

Scenario (b)

Expected Cash Flows $ 7.2 $(.2) $.3

Accretable Difference 2.1 (.1) .1

Allowance for Loan and

Lease Losses (1.0) (.2) .3

(a) Declining Scenario – Reflects hypothetical changes that would decrease future cash

flow expectations. For consumer loans, we assume home price forecast decreases by

ten percent and unemployment rate forecast increases by two percentage points; for

commercial loans, we assume that collateral values decrease by ten percent.

(b) Improving Scenario – Reflects hypothetical changes that would increase future cash

flow expectations. For consumer loans, we assume home price forecast increases by

ten percent, unemployment rate forecast decreases by two percentage points and

interest rate forecast increases by two percentage points; for commercial loans, we

assume that collateral values increase by ten percent.

The present value impact of declining cash flows is primarily

reflected as immediate impairment charge to the provision for

credit losses, resulting in an increase to the allowance for loan

and lease losses. The present value impact of increased cash

flows is first recognized as a reversal of the allowance with

any additional cash flow increases reflected as an increase in

accretable yield over the life of the loan.

N

ET

U

NFUNDED

C

REDIT

C

OMMITMENTS

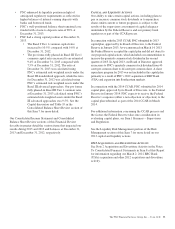

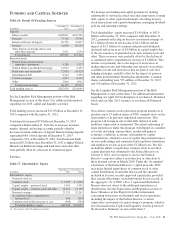

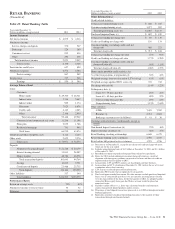

Net unfunded credit commitments are comprised of the

following:

Table 13: Net Unfunded Credit Commitments

In millions

December 31

2013

December 31

2012

Total commercial lending (a) $ 90,104 $ 78,703

Home equity lines of credit 18,754 19,814

Credit card 16,746 17,381

Other 4,266 4,694

Total $129,870 $120,592

(a) Less than 5% of net unfunded credit commitments relate to commercial real estate at

each date.

Commitments to extend credit represent arrangements to lend

funds or provide liquidity subject to specified contractual

conditions. Commercial commitments reported above exclude

syndications, assignments and participations, primarily to

financial institutions, totaling $25.0 billion at December 31,

2013 and $22.5 billion at December 31, 2012.

Unfunded liquidity facility commitments and standby bond

purchase agreements totaled $1.3 billion at December 31,

2013 and $1.4 billion at December 31, 2012 and are included

in the preceding table, primarily within the Total commercial

lending category.

In addition to the credit commitments set forth in the table

above, our net outstanding standby letters of credit totaled

$10.5 billion at December 31, 2013 and $11.5 billion at

December 31, 2012. Standby letters of credit commit us to

make payments on behalf of our customers if specified future

events occur.

Information regarding our Allowance for unfunded loan

commitments and letters of credit is included in Note 7

Allowance for Loan and Lease Losses and Unfunded Loan

Commitments and Letters of Credit in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

42 The PNC Financial Services Group, Inc. – Form 10-K