PNC Bank 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

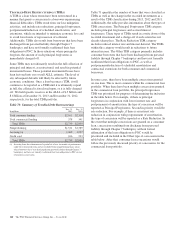

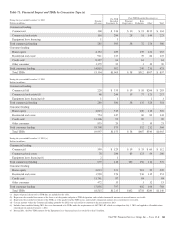

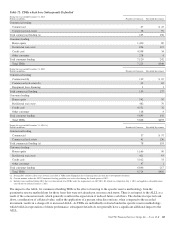

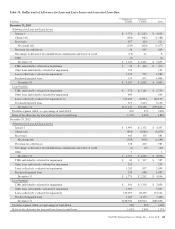

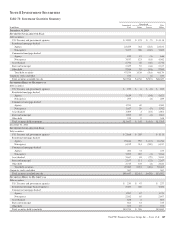

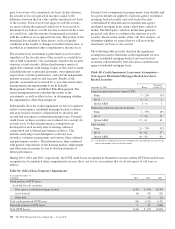

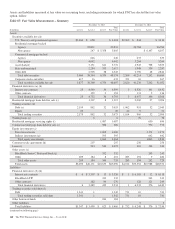

Table 78: Investment Securities Summary

(continued from previous page)

In millions

Amortized

Cost

Unrealized Fair

ValueGains Losses

December 31, 2011

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

U.S. Treasury and government agencies $ 3,369 $ 348 $ 3,717

Residential mortgage-backed

Agency 26,081 772 $ (61) 26,792

Non-agency 6,673 152 (1,268) 5,557

Commercial mortgage-backed

Agency 1,101 39 1,140

Non-agency 2,693 80 (17) 2,756

Asset-backed 3,854 31 (216) 3,669

State and municipal 1,779 75 (47) 1,807

Other debt 2,691 83 (12) 2,762

Total debt securities 48,241 1,580 (1,621) 48,200

Corporate stocks and other 368 368

Total securities available for sale $48,609 $1,580 $(1,621) $48,568

S

ECURITIES

H

ELD TO

M

ATURITY

(a)

Debt securities

U.S. Treasury and government agencies $ 221 $ 40 $ 261

Residential mortgage-backed (agency) 4,761 131 $ (1) 4,891

Commercial mortgage-backed

Agency 1,332 50 1,382

Non-agency 3,467 108 (2) 3,573

Asset-backed 1,251 14 (3) 1,262

State and municipal 671 31 702

Other debt 363 16 379

Total securities held to maturity $12,066 $ 390 $ (6) $12,450

(a) Held to maturity securities transferred from available for sale are included in held to maturity at fair value at the time of transfer. The amortized cost of held to maturity securities

included net unrealized gains of $111 million, $142 million and $179 million at December 31, 2013, 2012 and 2011, respectively, related to securities transferred, which are offset in

Accumulated Other Comprehensive Income, net of tax.

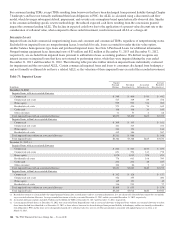

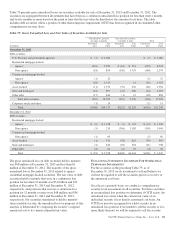

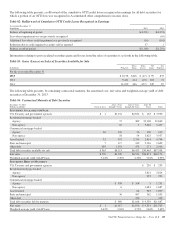

The fair value of investment securities is impacted by interest

rates, credit spreads, market volatility and liquidity conditions.

Net unrealized gains and losses in the securities available for

sale portfolio are included in Shareholders’ equity as

Accumulated other comprehensive income or loss, net of tax,

unless credit-related. Securities held to maturity are carried at

amortized cost. At December 31, 2013, Accumulated other

comprehensive income included pretax gains of $69 million

from derivatives that hedged the purchase of investment

securities classified as held to maturity. The gains will be

accreted into interest income as an adjustment of yield on the

securities.

During 2013, we transferred securities with a fair value of

$1.9 billion from available for sale to held to maturity. The

securities transferred included $.9 billion of agency residential

mortgage-backed securities, $.3 billion of non-agency

residential mortgage backed securities, $.3 billion of non-

agency commercial mortgage-backed securities and $.4 billion

of state and municipal securities. The non-agency mortgage-

backed and state and municipal securities were predominately

AAA-equivalent. In addition, the non-agency residential

mortgage-backed securities were 2013 originations. We

changed our intent and committed to hold these high-quality

securities to maturity in order to reduce the impact of price

volatility on Accumulated other comprehensive income and

certain capital measures, taking into consideration market

conditions and changes to regulatory capital requirements

under Basel III capital standards. The securities were

reclassified at fair value at the time of transfer and the transfer

represented a non-cash transaction. Accumulated other

comprehensive income included net pretax unrealized gains of

$11 million at transfer, which are being accreted over the

remaining life of the related securities as an adjustment of

yield in a manner consistent with the amortization of the net

premium on the same transferred securities, resulting in no

impact on net income.

150 The PNC Financial Services Group, Inc. – Form 10-K