PNC Bank 2013 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

T

ROUBLED

D

EBT

R

ESTRUCTURINGS

(TDR

S

)

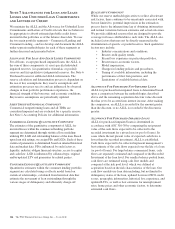

A TDR is a loan whose terms have been restructured in a

manner that grants a concession to a borrower experiencing

financial difficulties. TDRs result from our loss mitigation

activities, and include rate reductions, principal forgiveness,

postponement/reduction of scheduled amortization, and

extensions, which are intended to minimize economic loss and

to avoid foreclosure or repossession of collateral.

Additionally, TDRs also result from borrowers that have been

discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan

obligations to PNC. In those situations where principal is

forgiven, the amount of such principal forgiveness is

immediately charged off.

Some TDRs may not ultimately result in the full collection of

principal and interest, as restructured, and result in potential

incremental losses. These potential incremental losses have

been factored into our overall ALLL estimate. The level of

any subsequent defaults will likely be affected by future

economic conditions. Once a loan becomes a TDR, it will

continue to be reported as a TDR until it is ultimately repaid

in full, the collateral is foreclosed upon, or it is fully charged

off. We held specific reserves in the ALLL of $.5 billion and

$.6 billion at December 31, 2013 and December 31, 2012,

respectively, for the total TDR portfolio.

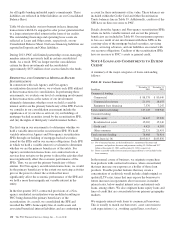

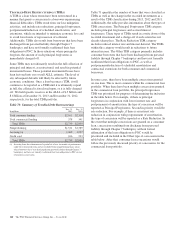

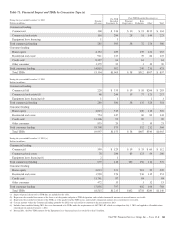

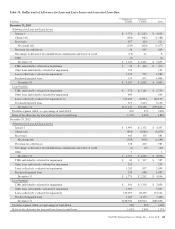

Table 70: Summary of Troubled Debt Restructurings

In millions

Dec. 31

2013

Dec. 31

2012

Total consumer lending $2,161 $2,318

Total commercial lending 578 541

Total TDRs $2,739 $2,859

Nonperforming $1,511 $1,589

Accruing (a) 1,062 1,037

Credit card 166 233

Total TDRs $2,739 $2,859

(a) Accruing loans have demonstrated a period of at least six months of performance

under the restructured terms and are excluded from nonperforming loans. Loans

where borrowers have been discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan obligations to PNC are not

returned to accrual status.

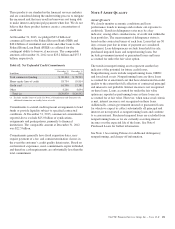

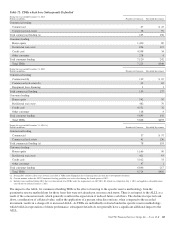

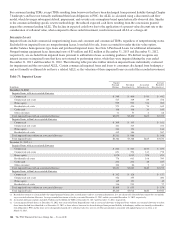

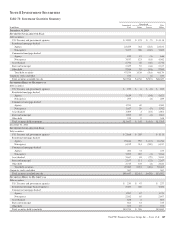

Table 71 quantifies the number of loans that were classified as

TDRs as well as the change in the recorded investments as a

result of the TDR classification during 2013, 2012 and 2011.

Additionally, the table provides information about the types of

TDR concessions. The Principal Forgiveness TDR category

includes principal forgiveness and accrued interest

forgiveness. These types of TDRs result in a write down of the

recorded investment and a charge-off if such action has not

already taken place. The Rate Reduction TDR category

includes reduced interest rate and interest deferral. The TDRs

within this category would result in reductions to future

interest income. The Other TDR category primarily includes

consumer borrowers that have been discharged from personal

liability through Chapter 7 bankruptcy and have not formally

reaffirmed their loan obligations to PNC, as well as

postponement/reduction of scheduled amortization and

contractual extensions for both consumer and commercial

borrowers.

In some cases, there have been multiple concessions granted

on one loan. This is most common within the commercial loan

portfolio. When there have been multiple concessions granted

in the commercial loan portfolio, the principal forgiveness

TDR was prioritized for purposes of determining the inclusion

in the table below. For example, if there is principal

forgiveness in conjunction with lower interest rate and

postponement of amortization, the type of concession will be

reported as Principal Forgiveness. Second in priority would be

rate reduction. For example, if there is an interest rate

reduction in conjunction with postponement of amortization,

the type of concession will be reported as a Rate Reduction. In

the event that multiple concessions are granted on a consumer

loan, concessions resulting from discharge from personal

liability through Chapter 7 bankruptcy without formal

affirmation of the loan obligations to PNC would be

prioritized and included in the Other type of concession in the

table below. After that, consumer loan concessions would

follow the previously discussed priority of concessions for the

commercial loan portfolio.

140 The PNC Financial Services Group, Inc. – Form 10-K