PNC Bank 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

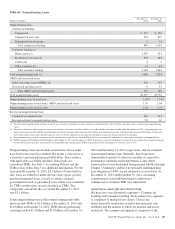

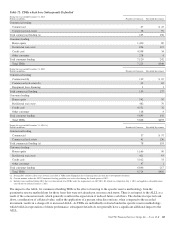

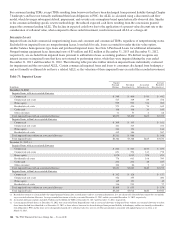

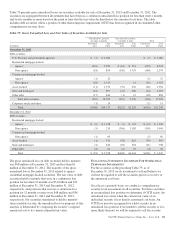

Table 72: TDRs which have Subsequently Defaulted

During the year ended December 31, 2013

Dollars in millions Number of Contracts Recorded Investment

Commercial lending

Commercial 67 $ 47

Commercial real estate 38 59

Total commercial lending (a) 105 106

Consumer lending

Home equity 1,420 89

Residential real estate 824 115

Credit card 4,598 34

Other consumer 278 4

Total consumer lending 7,120 242

Total TDRs 7,225 $348

During the year ended December 31, 2012

Dollars in millions Number of Contracts Recorded Investment

Commercial lending

Commercial (b) 112 $ 67

Commercial real estate (b) 42 69

Equipment lease financing 11

Total commercial lending 155 137

Consumer lending

Home equity 542 50

Residential real estate 482 70

Credit card 4,551 32

Other consumer 118 4

Total consumer lending 5,693 156

Total TDRs 5,848 $293

During the year ended December 31, 2011 (c)

Dollars in millions Number of Contracts Recorded Investment

Commercial lending

Commercial 37 $ 57

Commercial real estate 41 136

Total commercial lending (a) 78 193

Consumer lending

Home equity 1,166 90

Residential real estate 421 93

Credit card 5,012 33

Other consumer 47 1

Total consumer lending 6,646 217

Total TDRs 6,724 $410

(a) During 2013 and 2011, there were no loans classified as TDRs in the Equipment lease financing loan class that have subsequently defaulted.

(b) Certain amounts within the 2012 Commercial lending portfolio were reclassified during the fourth quarter of 2013.

(c) Includes loans modified during 2011 that were determined to be TDRs under the requirements of ASU 2011-02, which was adopted on July 1, 2011 and applied to all modifications

entered into on and after January 1, 2011.

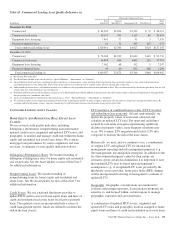

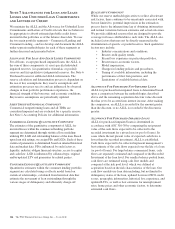

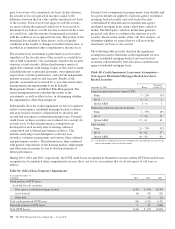

The impact to the ALLL for commercial lending TDRs is the effect of moving to the specific reserve methodology from the

quantitative reserve methodology for those loans that were not already put on nonaccrual status. There is an impact to the ALLL as a

result of the concession made, which generally results in the expectation of reduced future cash flows. The decline in expected cash

flows, consideration of collateral value, and/or the application of a present value discount rate, when compared to the recorded

investment, results in a charge-off or increased ALLL. As TDRs are individually evaluated under the specific reserve methodology,

which builds in expectations of future performance, subsequent defaults do not generally have a significant additional impact to the

ALLL.

The PNC Financial Services Group, Inc. – Form 10-K 143