PNC Bank 2013 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

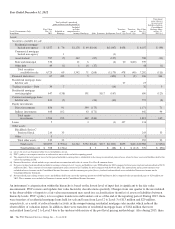

were transfers out of Level 3 residential mortgage loans held for sale and loans of $12 million and $28 million, respectively,

primarily due to the transfer of residential mortgage loans held for sale and loans to OREO. In addition, there was approximately

$84 million of Level 3 residential mortgage loans held for sale reclassified to Level 3 loans during 2013 due to the loans being

reclassified from held for sale loans to held in portfolio loans. This amount was included in Transfers out of Level 3 residential

mortgages loans held for sale and Transfers into Level 3 loans within Table 88. During 2012, there were transfers of securities

available for sale from Level 2 to Level 3 of $478 million consisting of mortgage-backed securities as a result of a ratings

downgrade which reduced the observability of valuation inputs and certain state and municipal securities with valuation inputs that

were determined to be unobservable. Level 2 to Level 3 transfers also included $127 million and $27 million for loans and

residential mortgage loans held for sale, respectively, as a result of reduced market activity in the nonperforming residential

mortgage sales market which reduced the observability of valuation inputs. Also during 2012, there was a transfer out of Level 3

securities available for sale of $40 million due to an instrument being reclassified to a loan and no longer being carried at fair

value.

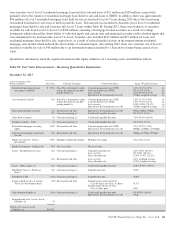

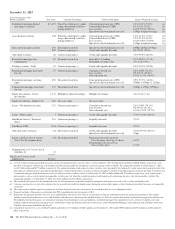

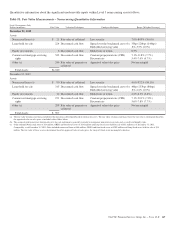

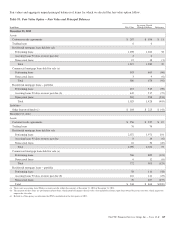

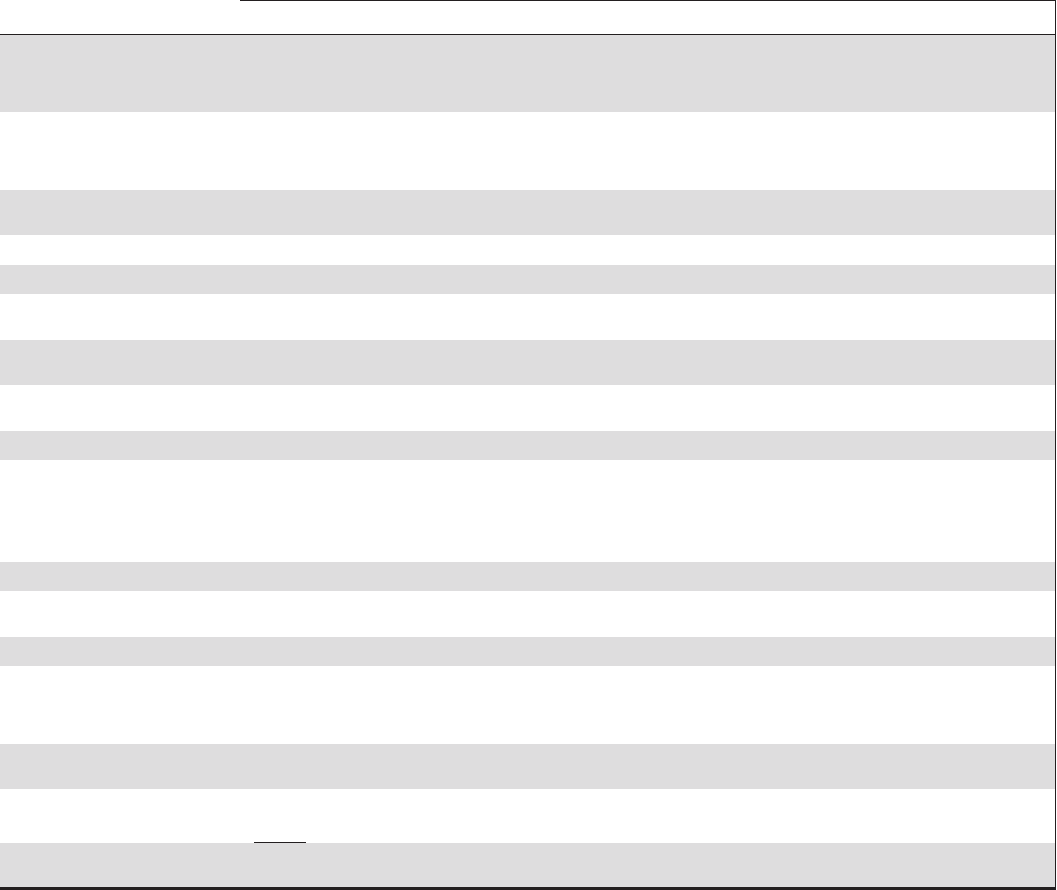

Quantitative information about the significant unobservable inputs within Level 3 recurring assets and liabilities follows.

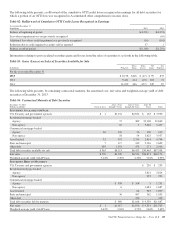

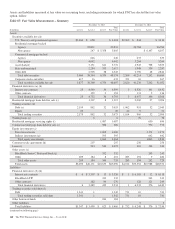

Table 89: Fair Value Measurements – Recurring Quantitative Information

December 31, 2013

Level 3 Instruments Only

Dollars in millions Fair Value Valuation Techniques Unobservable Inputs Range (Weighted Average)

Residential mortgage-backed

non-agency securities

$ 5,358 Priced by a third-party vendor

using a discounted cash flow

pricing model (a)

Constant prepayment rate (CPR)

Constant default rate (CDR)

Loss severity

Spread over the benchmark curve (b)

1.0%-32.1% (6.0%)

0%-21.9% (6.6%)

6.1%-92.9% (52.3%)

237bps weighted average

(a)

(a)

(a)

(a)

Asset-backed securities 641 Priced by a third-party vendor

using a discounted cash flow

pricing model (a)

Constant prepayment rate (CPR)

Constant default rate (CDR)

Loss severity

Spread over the benchmark curve (b)

1.0%-11.1% (5.0%)

1.0%-13.9% (8.7%)

10.0%-100% (70.1%)

326bps weighted average

(a)

(a)

(a)

(a)

State and municipal securities 132

201

Discounted cash flow

Consensus pricing (c)

Spread over the benchmark curve (b)

Credit and Liquidity discount

80bps-240bps (97bps)

0%-25.0% (8.3%)

Other debt securities 38 Consensus pricing (c) Credit and Liquidity discount 7.0%-95.0% (88.4%)

Trading securities – Debt 32 Consensus pricing (c) Credit and Liquidity discount 0%-20.0% (8.3%)

Residential mortgage servicing

rights

1,087 Discounted cash flow Constant prepayment rate (CPR)

Spread over the benchmark curve (b)

2.2%-32.9% (7.6%)

889bps-1,888bps (1,024bps)

Commercial mortgage loans held

for sale

586 Discounted cash flow Spread over the benchmark curve (b) 460bps-6,655bps (972bps)

Equity investments – Direct

investments

1,069 Multiple of adjusted earnings Multiple of earnings 4.5x-10.8x (7.2x)

Equity investments – Indirect (d) 595 Net asset value Net asset value

Loans – Residential real estate 225 Consensus pricing (c) Cumulative default rate

Loss severity

Gross discount rate

2.0%-100% (80.0%)

0%-100% (48.4%)

12.0%-13.0% (12.2%)

164 Discounted cash flow Loss severity

Gross discount rate

8.0% weighted average

10.0% weighted average

Loans – Home equity (e) 123 Consensus pricing (c) Credit and Liquidity discount 36.0%-99.0% (55.0%)

BlackRock Series C Preferred

Stock

332 Consensus pricing (c) Liquidity discount 20.0%

BlackRock LTIP (332) Consensus pricing (c) Liquidity discount 20.0%

Swaps related to sales of certain

Visa Class B common shares

(90) Discounted cash flow Estimated conversion factor of

Class B shares into Class A shares

Estimated growth rate of Visa

Class A share price

41.7%

8.6%

Other borrowed funds (e) (184) Consensus pricing (c) Credit and Liquidity discount

Spread over the benchmark curve (b)

0%-99.0% (18.0%)

13bps

Insignificant Level 3 assets, net of

liabilities (f) 35

Total Level 3 assets, net of

liabilities (g) $10,012

The PNC Financial Services Group, Inc. – Form 10-K 163