PNC Bank 2013 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

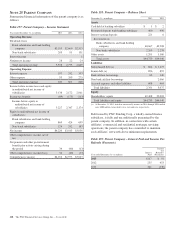

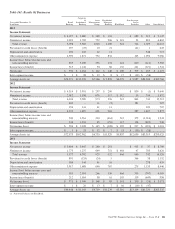

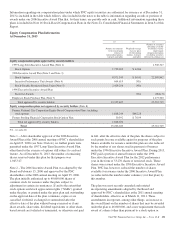

Table 161: Results Of Businesses

Year ended December 31

In millions

Retail

Banking

Corporate

&

Institutional

Banking

Asset

Management

Group

Residential

Mortgage

Banking BlackRock

Non-Strategic

Assets

Portfolio Other Consolidated

2013

Income Statement

Net interest income $ 4,077 $ 3,680 $ 288 $ 194 $ 689 $ 219 $ 9,147

Noninterest income 2,021 1,702 752 906 $ 621 53 810 6,865

Total revenue 6,098 5,382 1,040 1,100 621 742 1,029 16,012

Provision for credit losses (benefit) 657 (25) 10 21 (21) 1 643

Depreciation and amortization 186 128 42 11 348 715

Other noninterest expense 4,390 1,871 732 834 163 1,096 9,086

Income (loss) before income taxes and

noncontrolling interests 865 3,408 256 234 621 600 (416) 5,568

Income taxes (benefit) 315 1,144 94 86 152 221 (671) 1,341

Net income $ 550 $ 2,264 $ 162 $ 148 $ 469 $ 379 $ 255 $ 4,227

Inter-segment revenue $ 3 $ 28 $ 12 $ 8 $ 17 $ (10) $ (58)

Average Assets (a) $74,971 $112,970 $7,366 $ 9,896 $6,272 $ 9,987 $84,304 $305,766

2012

Income Statement

Net interest income $ 4,314 $ 3,991 $ 297 $ 209 $ 830 $ (1) $ 9,640

Noninterest income 2,012 1,598 676 317 $ 512 13 744 5,872

Total revenue 6,326 5,589 973 526 512 843 743 15,512

Provision for credit losses (benefit) 800 – 11 (5) 181 – 987

Depreciation and amortization 194 141 41 11 320 707

Other noninterest expense 4,392 1,887 691 981 287 1,637 9,875

Income (loss) before income taxes and

noncontrolling interests 940 3,561 230 (461) 512 375 (1,214) 3,943

Income taxes (benefit) 344 1,233 85 (153) 117 138 (822) 942

Net income (loss) $ 596 $ 2,328 $ 145 $ (308) $ 395 $ 237 $ (392) $ 3,001

Inter-segment revenue $ 1 $ 33 $ 12 $ 7 $ 15 $ (10) $ (58)

Average Assets (a) $72,573 $102,962 $6,735 $11,529 $5,857 $12,050 $83,319 $295,025

2011

Income Statement

Net interest income $ 3,804 $ 3,465 $ 280 $ 201 $ 913 $ 37 $ 8,700

Noninterest income 1,773 1,237 649 751 $ 464 47 705 5,626

Total revenue 5,577 4,702 929 952 464 960 742 14,326

Provision for credit losses (benefit) 891 (124) (24) 5 366 38 1,152

Depreciation and amortization 186 144 41 10 278 659

Other noninterest expense 3,917 1,688 646 787 275 1,133 8,446

Income (loss) before income taxes and

noncontrolling interests 583 2,994 266 150 464 319 (707) 4,069

Income taxes (benefit) 212 1,054 98 61 103 119 (649) 998

Net income (loss) $ 371 $ 1,940 $ 168 $ 89 $ 361 $ 200 $ (58) $ 3,071

Inter-segment revenue $ 1 $ 20 $ 13 $ 7 $ 16 $ (10) $ (47)

Average Assets (a) $66,448 $ 81,043 $6,719 $11,270 $5,516 $13,119 $81,220 $265,335

(a) Period-end balances for BlackRock.

The PNC Financial Services Group, Inc. – Form 10-K 221