PNC Bank 2013 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

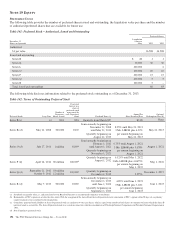

Our Series L preferred stock was issued in connection with the

National City transaction in exchange for National City’s

Fixed-to-Floating Rate Non-Cumulative Preferred Stock,

Series F. Dividends on the Series L preferred stock were

payable if and when declared each 1st of February, May,

August and November. Dividends were paid at a rate of

9.875% prior to February 1, 2013 and at a rate of three-month

LIBOR plus 633 basis points beginning February 1, 2013. On

April 19, 2013, PNC redeemed all 6,000,000 depositary shares

representing interests in PNC’s Series L preferred stock and

all 1,500 shares of Series L preferred stock underlying such

depositary shares, resulting in a net outflow of $150 million.

We have authorized but unissued Series H and Series I

preferred stock. As described in Note 14 Capital Securities of

Subsidiary Trusts and Perpetual Trust Securities, the PNC

Preferred Funding Trust II securities that currently qualify as

capital for regulatory purposes are automatically exchangeable

into shares of PNC Series I preferred stock under certain

conditions relating to the capitalization or the financial

condition of PNC Bank, N.A. and upon the direction of the

Office of the Comptroller of the Currency. The Series A

preferred stock of PNC REIT Corp. is also automatically

exchangeable under similar conditions into shares of PNC

Series H preferred stock. As described in Note 14, on

March 15, 2013, we redeemed all $375 million of the PNC

Preferred Funding Trust III securities that had been

exchangeable under certain conditions into PNC Series J

preferred stock.

W

ARRANTS

We have outstanding 16,885,192 warrants, each to purchase

one share of PNC common stock at an exercise price of

$67.33 per share. These warrants were sold by the U.S.

Treasury in a secondary public offering that closed on May 5,

2010 after the U.S. Treasury exchanged its TARP Warrant

(issued on December 31, 2008 under the TARP Capital

Purchase Program) for 16,885,192 warrants. These warrants

expire December 31, 2018.

O

THER

S

HAREHOLDERS

’E

QUITY

M

ATTERS

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 368,982 shares in

2013, 422,642 shares in 2012 and 379,459 shares in 2011.

At December 31, 2013, we had reserved approximately

103.5 million common shares to be issued in connection with

certain stock plans.

Effective October 4, 2007, our Board of Directors approved a

stock repurchase program to purchase up to 25 million shares

of PNC common stock on the open market or in privately

negotiated transactions. A maximum of 21.551 million shares

remained available for repurchase under this program at

December 31, 2013. This program will remain in effect until

fully utilized or until modified, superseded or terminated. We

repurchased 3.2 million shares in 2012 and did not repurchase

any shares during 2013 under this program.

The PNC Financial Services Group, Inc. – Form 10-K 199