PNC Bank 2013 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2013 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

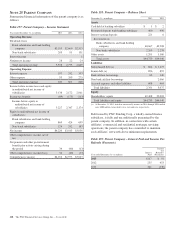

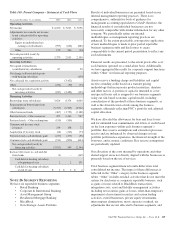

Table 160: Parent Company – Statement of Cash Flows

Year ended December 31– in millions 2013 2012 2011

Operating Activities

Net income $ 4,220 $ 3,013 $ 3,056

Adjustments to reconcile net income

to net cash provided by operating

activities:

Equity in undistributed net

earnings of subsidiaries (993) (666) (882)

Other 152 566 (24)

Net cash provided (used) by

operating activities 3,379 2,913 2,150

Investing Activities

Net capital returned from

(contributed to) subsidiaries 87 50

Net change in Restricted deposits

with banking subsidiary (150)

Net cash paid for acquisition activity (3,432)

Other (274) (50) (35)

Net cash provided (used) by

investing activities (187) (3,482) (135)

Financing Activities

Borrowings from subsidiaries 3,624 8,374 4,660

Repayments on borrowings from

subsidiaries (5,767) (6,943) (4,962)

Other borrowed funds (467) (1,753) (2,188)

Preferred stock – Other issuances 495 2,446 987

Preferred stock – Other redemptions (150) (500)

Common and treasury stock

issuances 244 158 72

Acquisition of treasury stock (24) (216) (73)

Preferred stock cash dividends paid (237) (177) (56)

Common stock cash dividends paid (911) (820) (604)

Net cash provided (used) by

financing activities (3,193) 569 (2,164)

Increase (decrease) in cash and due

from banks (1) – (149)

Cash held at banking subsidiary

at beginning of year 2 2 151

Cash held at banking subsidiary

at end of year $ 1 $ 2 $ 2

N

OTE

26 S

EGMENT

R

EPORTING

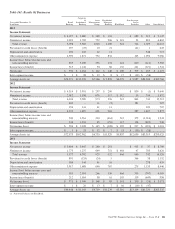

We have six reportable business segments:

• Retail Banking

• Corporate & Institutional Banking

• Asset Management Group

• Residential Mortgage Banking

• BlackRock

• Non-Strategic Assets Portfolio

Results of individual businesses are presented based on our

internal management reporting practices. There is no

comprehensive, authoritative body of guidance for

management accounting equivalent to GAAP; therefore, the

financial results of our individual businesses are not

necessarily comparable with similar information for any other

company. We periodically refine our internal

methodologies as management reporting practices are

enhanced. To the extent practicable, retrospective application

of new methodologies is made to prior period reportable

business segment results and disclosures to create

comparability to the current period presentation to reflect any

such refinements.

Financial results are presented, to the extent practicable, as if

each business operated on a stand-alone basis. Additionally,

we have aggregated the results for corporate support functions

within “Other” for financial reporting purposes.

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors. A portion of capital is intended to cover

unexpected losses and is assigned to our business segments

using our risk-based economic capital model, including

consideration of the goodwill at those business segments, as

well as the diversification of risk among the business

segments, ultimately reflecting PNC’s portfolio risk adjusted

capital allocation.

We have allocated the allowances for loan and lease losses

and for unfunded loan commitments and letters of credit based

on the loan exposures within each business segment’s

portfolio. Key reserve assumptions and estimation processes

react to and are influenced by observed changes in loan

portfolio performance experience, the financial strength of the

borrower, and economic conditions. Key reserve assumptions

are periodically updated.

Our allocation of the costs incurred by operations and other

shared support areas not directly aligned with the businesses is

primarily based on the use of services.

Total business segment financial results differ from total

consolidated net income. The impact of these differences is

reflected in the “Other” category in the business segment

tables. “Other” includes residual activities that do not meet the

criteria for disclosure as a separate reportable business, such

as gains or losses related to BlackRock transactions,

integration costs, asset and liability management activities

including net securities gains or losses, other-than-temporary

impairment of investment securities and certain trading

activities, exited businesses, private equity investments,

intercompany eliminations, most corporate overhead, tax

adjustments that are not allocated to business segments, and

The PNC Financial Services Group, Inc. – Form 10-K 219