NVIDIA 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

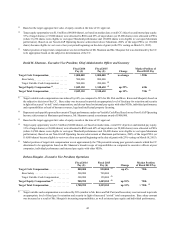

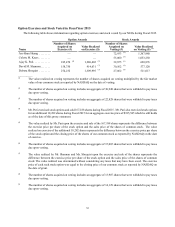

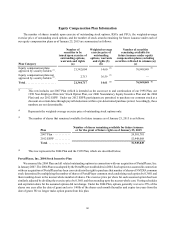

Option Exercises and Stock Vested in Fiscal Year 2015

The following table shows information regarding option exercises and stock vested by our NEOs during Fiscal 2015.

Name

Option Awards Stock Awards

Number of Shares

Acquired on

Exercise (#) Value Realized

on Exercise ($)

Number of Shares

Acquired on

Vesting (#) Value Realized

on Vesting ($) (1)

Jen-Hsun Huang . . . . . . . . — — 72,933 (2) 1,367,980

Colette M. Kress . . . . . . . . — — 55,000 (3) 1,053,250

Ajay K. Puri. . . . . . . . . . . . 185,470 (4) 1,280,402 (5) 32,875 (6) 620,876

David M. Shannon. . . . . . . 158,750 914,631 (7) 30,562 (8) 577,128

Debora Shoquist . . . . . . . . 274,232 1,309,995 (7) 27,062 (9) 511,017

__________

(1) The value realized on vesting represents the number of shares acquired on vesting multiplied by the fair market

value of our common stock as reported by NASDAQ on the date of vesting.

(2) The number of shares acquired on vesting includes an aggregate of 30,948 shares that were withheld to pay taxes

due upon vesting.

(3) The number of shares acquired on vesting includes an aggregate of 22,828 shares that were withheld to pay taxes

due upon vesting.

(4) Mr. Puri exercised stock options and sold 167,188 shares during Fiscal 2015. Mr. Puri also exercised stock options

for an additional 18,282 shares during Fiscal 2015 for an aggregate exercise price of $185,545 which he still holds

as of the date of this proxy statement.

(5) The value realized by Mr. Puri upon the exercise and sale of the 167,188 shares represents the difference between

the exercise price per share of the stock option and the sales price of the shares of common stock. The value

realized on exercise of the additional 18,282 shares represents the difference between the exercise price per share

of the stock option and the closing price of the shares of our common stock as reported by NASDAQ on the date

of exercise.

(6) The number of shares acquired on vesting includes an aggregate of 15,005 shares that were withheld to pay taxes

due upon vesting.

(7) The value realized by Mr. Shannon and Ms. Shoquist upon the exercise and sale of the shares represents the

difference between the exercise price per share of the stock option and the sales price of the shares of common

stock. The value realized was determined without considering any taxes that may have been owed. The exercise

price of each such stock option was equal to the closing price of our common stock as reported by NASDAQ on

the date of grant.

(8) The number of shares acquired on vesting includes an aggregate of 13,907 shares that were withheld to pay taxes

due upon vesting.

(9) The number of shares acquired on vesting includes an aggregate of 14,129 shares that were withheld to pay taxes

due upon vesting.