NVIDIA 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

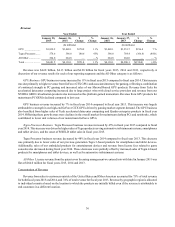

27

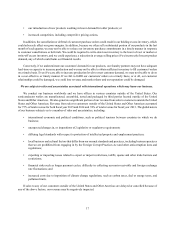

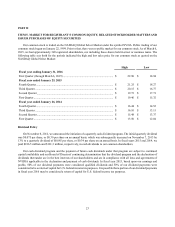

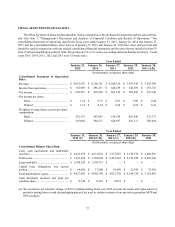

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with our financial statements and the notes thereto,

and with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The

consolidated statements of operations data for the fiscal years ended January 25, 2015, January 26, 2014 and January 27,

2013 and the consolidated balance sheet data as of January 25, 2015 and January 26, 2014 have been derived from and

should be read in conjunction with our audited consolidated financial statements and the notes thereto included in Part IV,

Item 15 in this Annual Report on Form 10-K. We operate on a 52- or 53-week year, ending on the last Sunday in January. Fiscal

years 2015, 2014, 2013, 2012 and 2011 were 52-week years.

Year Ended

January 25,

2015 January 26,

2014 January 27,

2013 January 29,

2012 January 30,

2011 (A,B)

(In thousands, except per share data)

Consolidated Statement of Operations

Data:

Revenue....................................................... $ 4,681,507 $ 4,130,162 $ 4,280,159 $ 3,997,930 $ 3,543,309

Income from operations............................... $ 758,989 $ 496,227 $ 648,239 $ 648,299 $ 255,747

Net income................................................... $ 630,587 $ 439,990 $ 562,536 $ 581,090 $ 253,146

Net income per share:

Basic..................................................... $ 1.14 $ 0.75 $ 0.91 $ 0.96 $ 0.44

Diluted.................................................. $ 1.12 $ 0.74 $ 0.90 $ 0.94 $ 0.43

Weighted average shares used in per share

computation:

Basic..................................................... 552,319 587,893 619,324 603,646 575,177

Diluted.................................................. 563,068 594,517 624,957 616,371 588,684

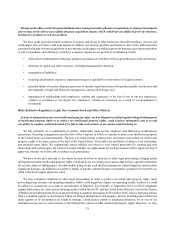

Year Ended

January 25,

2015 (C) January 26,

2014 (C,D) January 27,

2013 (C) January 29,

2012 (E) January 30,

2011

(In thousands, except per share data)

Consolidated Balance Sheet Data:

Cash, cash equivalents and marketable

securities...................................................... $ 4,623,339 $ 4,671,810 $ 3,727,883 $ 3,129,576 $ 2,490,563

Total assets................................................... $ 7,201,368 $ 7,250,894 $ 6,412,245 $ 5,552,928 $ 4,495,246

Long-term debt............................................ $ 1,384,342 $ 1,356,375 $ — $ — $ —

Capital lease obligations, less current

portion.......................................................... $ 14,086 $ 17,500 $ 18,998 $ 21,439 $ 23,389

Total shareholders’ equity............................ $ 4,417,982 $ 4,456,398 $ 4,827,703 $ 4,145,724 $ 3,181,462

Cash dividends declared and paid per

common share.............................................. $ 0.340 $ 0.310 $ 0.075 $ — $ —

(A) We recorded a net warranty charge of $193.9 million during fiscal year 2011 towards the repair and replacement of

products arising from a weak die/packaging material set used in certain versions of our previous generation MCP and

GPU products.