NVIDIA 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

by our competition. In addition, cancellation or deferral of customer purchase orders could result in our holding excess

inventory. Also, because we often sell a substantial portion of our products in the last month of each quarter, we may not

be able to reduce our inventory purchase commitments in a timely manner in response to customer cancellations or deferrals.

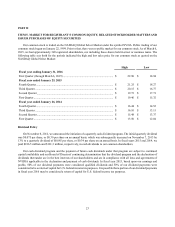

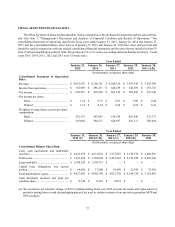

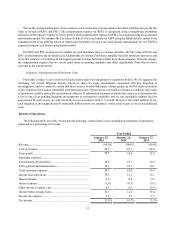

Charges to cost of sales for inventory provisions totaled $59.4 million, $50.1 million and $89.9 million for fiscal years

2015, 2014 and 2013, unfavorably impacting our gross margin by 1.3%, 1.2% and 2.1%, respectively. Sales of inventory

that was previously written-off or written-down totaled $32.4 million, $43.4 million and $53.7 million for fiscal years 2015,

2014 and 2013, favorably impacting our gross margin by 0.7%, 1.1% and 1.3%, respectively. As a result, the overall net

effect on our gross margin from inventory provisions and sales of items previously written down was an unfavorable impact

of 0.6%, 0.1% and 0.8% in fiscal years 2015, 2014 and 2013, respectively.

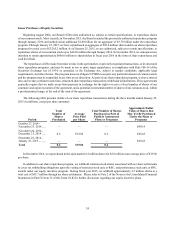

During fiscal years 2015, 2014 and 2013, the charges we took to cost of sales for inventory provisions were primarily

related to the write-off of excess quantities of GPU and Tegra Processor products whose inventory levels were higher than

our updated forecasts of future demand for those products. As a fabless semiconductor company, we must make commitments

to purchase inventory based on forecasts of future customer demand. In doing so, we must account for our third-party

manufacturers' lead times and constraints. We also adjust to other market factors, such as product offerings and pricing

actions by our competitors, new product transitions, and macroeconomic conditions - all of which may impact demand for

our products.

Please refer to the Gross Profit and Gross Margin discussion below in this Management's Discussion and Analysis for

further discussion.

Income Taxes

We recognize federal, state and foreign current tax liabilities or assets based on our estimate of taxes payable or refundable

in the current fiscal year by tax jurisdiction. We recognize federal, state and foreign deferred tax assets or liabilities, as

appropriate, for our estimate of future tax effects attributable to temporary differences and carryforwards; and we record a

valuation allowance to reduce any deferred tax assets by the amount of any tax benefits that, based on available evidence

and judgment, are not expected to be realized.

United States income tax has not been provided on a portion of earnings of our non-U.S. subsidiaries to the extent that

such earnings are considered to be indefinitely reinvested.

Our calculation of current and deferred tax assets and liabilities is based on certain estimates and judgments and involves

dealing with uncertainties in the application of complex tax laws. Our estimates of current and deferred tax assets and

liabilities may change based, in part, on added certainty or finality to an anticipated outcome, changes in accounting standards

or tax laws in the United States, or foreign jurisdictions where we operate, or changes in other facts or circumstances. In

addition, we recognize liabilities for potential United States and foreign income tax contingencies based on our estimate of

whether, and the extent to which, additional taxes may be due. If we determine that payment of these amounts is unnecessary

or if the recorded tax liability is less than our current assessment, we may be required to recognize an income tax benefit

or additional income tax expense in our financial statements accordingly.

As of January 25, 2015, we had a valuation allowance of $261.0 million related to state and certain foreign deferred

tax assets that management determined are not likely to be realized due, in part, to projections of future taxable income and

potential utilization limitations of tax attributes acquired as a result of stock ownership changes. To the extent realization

of the deferred tax assets becomes more-likely-than-not, we would recognize such deferred tax asset as an income tax benefit

during the period.