NVIDIA 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

79

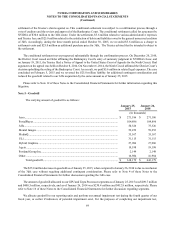

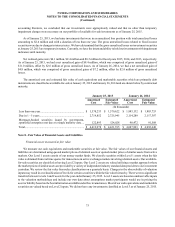

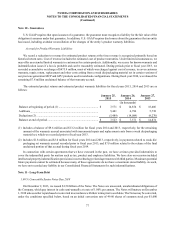

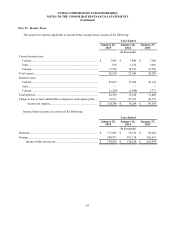

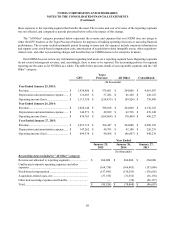

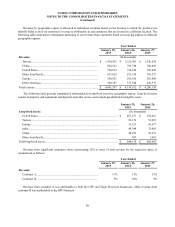

The following table presents the interest expense for the contractual interest and the accretion of debt discount:

Year Ended

January 25, 2015 January 26, 2014

(In thousands)

Contractual coupon interest expense.............................................................. $ 15,000 $ 2,500

Amortization of debt discount........................................................................ 27,967 4,600

Amortization of debt issuance costs............................................................... 195 34

Total interest expense related to Notes........................................................... $ 43,162 $ 7,134

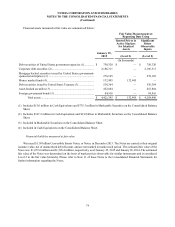

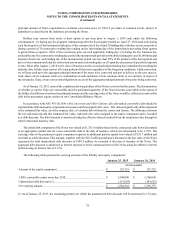

Note Hedges and Warrants

The net proceeds from the Notes were approximately $1,477.5 million after payment of the initial purchaser's discount.

Concurrently with the offering of the Notes, we entered into the Note Hedges with a strike price equal to the initial conversion

price of the Notes, or approximately $20.16 per share. The Note Hedges allow us to receive shares of our common stock

and/or cash related to the excess conversion value that we would pay to the holders of the Notes upon conversion. We paid

$167.1 million for the Note Hedges.

In addition, concurrent with the offering of the Notes and the purchase of the Note Hedges, we entered into a separate

warrant transaction, or the Warrants, with a strike price to the holders of the Warrants of $27.14 per share. The Warrants

are net share settled and cover, subject to customary antidilution adjustments, 74.4 million shares of our common stock.

We received $59.1 million for the Warrants transaction.

The $108.0 million net cost of the Note Hedges offset by the proceeds from the Warrants was included as a net reduction

to additional paid-in capital in the shareholders’ equity section of our consolidated balance sheets, in accordance with the

guidance in ASC 815-40 Derivatives and Hedging-Contracts in Entity's Own Equity.

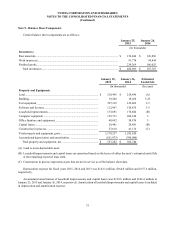

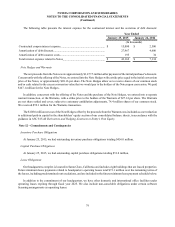

Note 12 - Commitments and Contingencies

Inventory Purchase Obligations

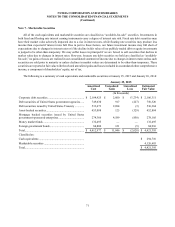

At January 25, 2015, we had outstanding inventory purchase obligations totaling $456.0 million.

Capital Purchase Obligations

At January 25, 2015, we had outstanding capital purchase obligations totaling $51.0 million.

Lease Obligations

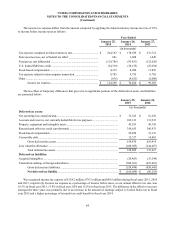

Our headquarters complex is located in Santa Clara, California and includes eight buildings that are leased properties.

Future minimum lease payments related to headquarters operating leases total $73.1 million over the remaining terms of

the leases, including predetermined rent escalations, and are included in the future minimum lease payment schedule below.

In addition to the commitment of our headquarters, we have other domestic and international office facilities under

operating leases expiring through fiscal year 2025. We also include non-cancelable obligations under certain software

licensing arrangements as operating leases.