NVIDIA 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

65

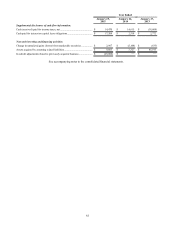

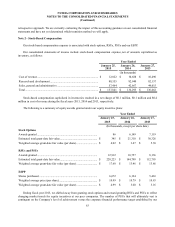

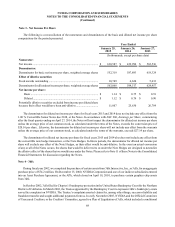

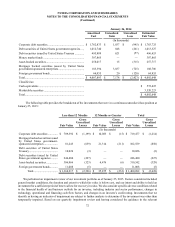

Year Ended

January 25,

2015 January 26,

2014 January 27,

2013

(Using the Black-Scholes model)

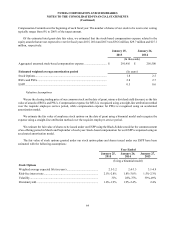

ESPP

Weighted average expected life (in years)............................................ 0.5-2.0 0.5-2.0 0.5-2.0

Risk-free interest rate............................................................................ 0.1%-0.5% 0.1%-0.4% 0.1%-0.3%

Volatility ............................................................................................... 23%-31% 32%-37% 44%-47%

Dividend yield ...................................................................................... 1.7%-1.9% 2.0%-2.4% —

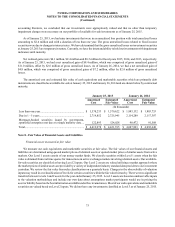

The expected life of employee stock options is a derived output of our valuation model and is impacted by the underlying

assumptions of our company. For ESPP shares, the expected term represents the average term from the first day of the

offering period to the purchase date.

The risk-free interest rate assumption used to value stock options and ESPP is based upon observed interest rates on

Treasury bills appropriate for the expected term of the award.

Our expected stock price volatility assumption for stock options and ESPP is estimated using implied volatility.

For awards granted on or subsequent to November 8, 2012, we use a dividend yield at grant date, based on the per

share dividends declared during the most recent quarter. Our RSU and PSU awards are not eligible for cash dividends prior

to vesting; therefore, the fair value of RSUs and PSUs is discounted by the dividend yield.

Additionally, for employee stock options and RSU and PSU awards, we estimate forfeitures annually and revise the

estimates of forfeiture in subsequent periods if actual forfeitures differ from those estimates. Forfeitures are estimated based

on historical experience.

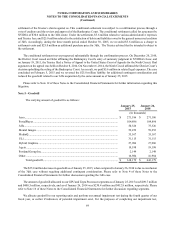

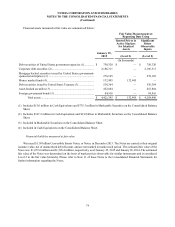

Equity Incentive Program

We grant stock options, RSUs, PSUs, and stock purchase rights under the following equity incentive plans.

Amended and Restated 2007 Equity Incentive Plan

In 2007, our shareholders approved the NVIDIA Corporation 2007 Equity Incentive Plan, or the 2007 Plan. The 2007

Plan was amended and restated in 2012, 2013 and 2014, or the Restated 2007 Plan.

The Restated 2007 Plan authorizes the issuance of incentive stock options, non-statutory stock options, restricted stock,

restricted stock unit, stock appreciation rights, performance stock awards, performance cash awards, and other stock-based

awards to employees, directors and consultants. Only our employees may receive incentive stock options. With the 2014

amendment and restatement of the 2007 Plan, which increased the number of shares of common stock authorized for issuance

under the 2007 Plan by 10,000,000 shares, up to 187,767,766 shares of our common stock may be issued pursuant to stock

awards granted under the Restated 2007 Plan. Currently, we grant stock options, RSUs and PSUs under the Restated 2007

Plan, under which, as of January 25, 2015, there were 24,501,781 shares available for future issuance.

Stock options granted to employees, subject to certain exceptions, vest over a four year period, subject to continued

service, with 25% vesting on the anniversary of the hire date in the case of new hires or the anniversary of the date of grant

in the case of grants to existing employees and 6.25% vesting at the end of each quarterly period thereafter. Options granted

under the 2007 Plan generally expire ten years from the date of grant.