NVIDIA 2015 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

77

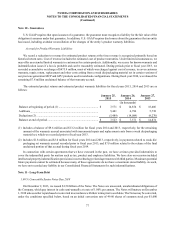

Note 10 - Guarantees

U.S. GAAP requires that upon issuance of a guarantee, the guarantor must recognize a liability for the fair value of the

obligation it assumes under that guarantee. In addition, U.S. GAAP requires disclosures about the guarantees that an entity

has issued, including a tabular reconciliation of the changes of the entity’s product warranty liabilities.

Accrual for Product Warranty Liabilities

We record a reduction to revenue for estimated product returns at the time revenue is recognized primarily based on

historical return rates. Cost of revenue includes the estimated cost of product warranties. Under limited circumstances, we

may offer an extended limited warranty to customers for certain products. Additionally, we accrue for known warranty and

indemnification issues if a loss is probable and can be reasonably estimated. During periods prior to fiscal year 2013, we

recorded a cumulative net charge of $475.9 million, most of which was charged against cost of revenue, to cover customer

warranty, repair, return, replacement and other costs arising from a weak die/packaging material set in certain versions of

our previous generation MCP and GPU products used in notebook configurations. During fiscal year 2014, we released the

remaining $7.8 million unclaimed balance of that warranty accrual.

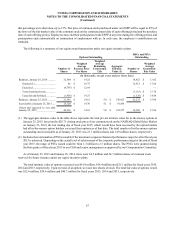

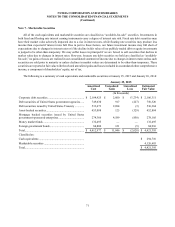

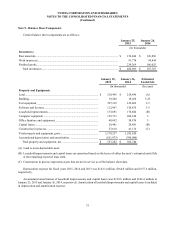

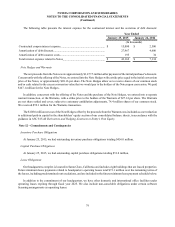

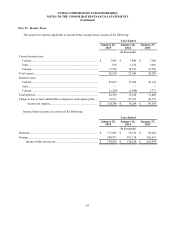

The estimated product returns and estimated product warranty liabilities for fiscal years 2015, 2014 and 2013 are as

follows:

January 25,

2015 January 26,

2014 January 27,

2013

(In thousands)

Balance at beginning of period (1) ....................................................... $ 7,571 $ 14,874 $ 18,406

Additions............................................................................................... 5,441 6,786 5,738

Deductions (2) ...................................................................................... (5,489)(14,089)(9,270)

Balance at end of period ....................................................................... $ 7,523 $ 7,571 $ 14,874

(1) Includes a balance of $9.6 million and $13.2 million for fiscal years 2014 and 2013, respectively, for the remaining

amount of the warranty accrual associated with incremental repair and replacement costs from a weak die/packaging

material set, which we recorded prior to fiscal year 2013.

(2) Includes $1.8 million and $3.0 million for fiscal years 2014 and 2013, respectively, in payments related to weak die/

packaging set warranty accrual recorded prior to fiscal year 2013, and $7.8 million related to the release of the final

unclaimed portion of that accrual during fiscal year 2014.

In connection with certain agreements that we have executed in the past, we have at times provided indemnities to

cover the indemnified party for matters such as tax, product and employee liabilities. We have also on occasion included

intellectual property indemnification provisions in our technology related agreements with third parties. Maximum potential

future payments cannot be estimated because many of these agreements do not have a maximum stated liability. As such,

we have not recorded any liability in our Consolidated Financial Statements for such indemnifications.

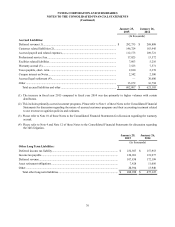

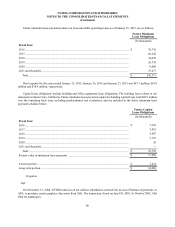

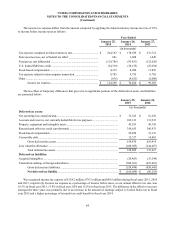

Note 11 - Long-Term Debt

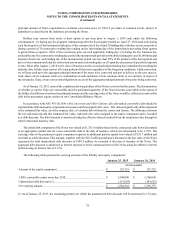

1.00 % Convertible Senior Notes Due 2018

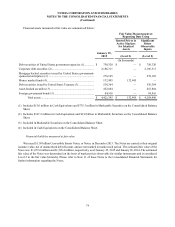

On December 2, 2013, we issued $1.50 billion of the Notes. The Notes are unsecured, unsubordinated obligations of

the Company, which pay interest in cash semi-annually at a rate of 1.00% per annum. The Notes will mature on December

1, 2018 unless earlier repurchased or converted in accordance with their terms prior to such date. The Notes may be converted,

under the conditions specified below, based on an initial conversion rate of 49.60 shares of common stock per $1,000