NVIDIA 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

67

this percentage at its discretion, up to 15%. The price of common stock purchased under our ESPP will be equal to 85% of

the lower of the fair market value of the common stock on the commencement date of each offering period and the purchase

date of each offering period. Employees may end their participation in the ESPP at any time during the offering period, and

participation ends automatically on termination of employment with us. In each case, the employee’s contributions are

refunded.

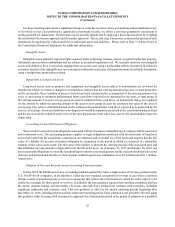

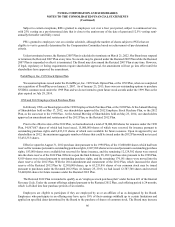

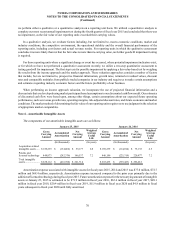

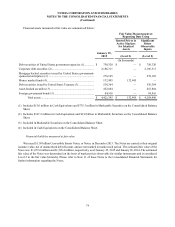

The following is a summary of our equity award transactions under our equity incentive plans:

Options Outstanding RSUs and PSUs

Outstanding

Number of

Shares

Weighted

Average

Exercise Price

Per Share

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value (1) Number of

Shares

Weighted

Average

Grant-Date

Fair Value

(In thousands, except years and per share data)

Balances, January 26, 2014............. 32,504 $ 14.22 18,852 $ 13.82

Granted (2)................................. 86 $ 18.75 12,912 $ 17.68

Exercised ................................... (9,795) $ 12.64 — —

Vested restricted stock............... — — (7,163) $ 13.78

Canceled and forfeited............... (1,450) $ 19.27 (1,326) $ 14.44

Balances, January 25, 2015............. 21,345 $ 14.61 5.9 $ 130,923 23,275 $ 15.94

Exercisable at January 25, 2015 ..... 15,120 $ 14.70 5.1 $ 91,434

Vested and expected to vest after

January 25, 2015............................. 20,356 $ 14.62 5.8 $ 124,575 18,988 $ 15.96

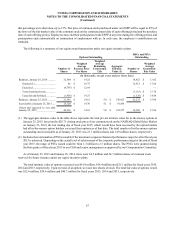

(1) The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value for in-the-money options at

January 25, 2015, based on the $20.71 closing stock price of our common stock on the NASDAQ Global Select Market

on January 23, 2015, the last trading day of fiscal year 2015, which would have been received by the option holders

had all in-the-money option holders exercised their options as of that date. The total number of in-the-money options

outstanding and exercisable as of January 25, 2015 was 21.1 million shares and 14.9 million shares, respectively.

(2) Includes the total number of PSUs issuable if the maximum corporate financial performance target level for fiscal year

2015 is achieved. Depending on the actual level of achievement of the corporate performance target at the end of fiscal

year 2015, the range of PSUs issued could be from 1.3 million to 2.5 million shares. The PSUs were granted during

the first quarter of fiscal year 2015 to our CEO and senior management as approved by our Compensation Committee.

As of January 25, 2015 and January 26, 2014, there were 24.5 million and 24.7 million shares of common stock

reserved for future issuance under our equity incentive plans.

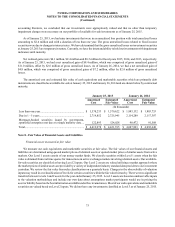

The total intrinsic value of options exercised was $61.9 million, $14.4 million and $21.1 million for fiscal years 2015,

2014 and 2013, respectively. Upon exercise of an option, we issue new shares of stock. The total fair value of options vested

was $32.6 million, $34.6 million and $40.3 million for fiscal years 2015, 2014 and 2013, respectively.