NVIDIA 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

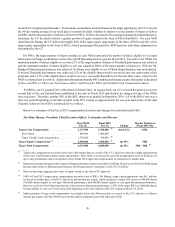

Factors Used in Determining Executive Compensation

In any given year, when establishing the elements of executive compensation, our CC may take into consideration one

or more of the following factors. The relative weight, if any, given to each of the factors below varies with each individual

NEO and with respect to each element of compensation at the sole discretion of our CC.

Factors we Consider

The need to attract new talent to our executive team and retain

existing talent in a highly competitive industry The need to motivate NEOs to address particular business

challenges that are unique to any given year

An NEO’s past performance and expected contribution to future

results A review of an NEO’s current total compensation

The Company’s performance, operating budget and expected

financial constraints Our CEO’s recommendations, because of his direct knowledge of

the results delivered and leadership demonstrated by each NEO

The trends in compensation paid to similarly situated officers at

our peer companies The independent judgment of the members of our CC

The 25th, 50th and 75th percentiles of compensation paid to

similarly situated NEOs at our peer companies based on the the

data gathered from the Radford Global Technology Survey

The total compensation cost and stockholder dilution resulting

from executive compensation actions, as we believe this helps us

maintain a responsible cost structure for our compensation

programs*

The philosophy that the total compensation opportunity and the

percentage of total compensation “at risk” should increase with

the level of responsibility-for example, because the CEO has

overall responsibility for our entire company, his total

compensation opportunity is significantly greater, as is his

percentage of performance-based compensation

Internal pay equity-that is, we assess an NEO’s responsibilities,

the scope of the NEO’s position and the complexity of the

department or function the NEO manages, relative to the NEO’s

internal peers, and set compensation levels within a relatively

narrow band for comparably situated executives

__________

* For a discussion of stock-based compensation cost, see Note 2 to our consolidated financial statements titled “Stock-Based Compensation” in our Form

10-K.

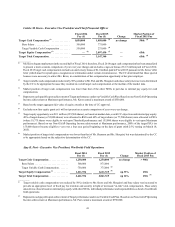

Peer Companies and Market Compensation Data

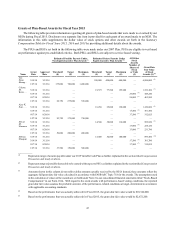

In late Fiscal 2014, Exequity and our human resources department recommended, and our CC approved, our peer

companies for Fiscal 2015 which are companies that (i) we generally think we compete with for executive talent, (ii) have

an established business, market presence, and complexity similar to us, and (iii) are of similar size to us as measured by

revenue (at roughly 0.5-2.0x NVIDIA) and market capitalizations (at roughly 0.5-3.5x NVIDIA). Our peer group for Fiscal

2015 remained the same as it was for Fiscal 2014. The median revenue and market capitalization for our peer group was

approximately $4.2 billion and $12.0 billion, respectively, which closely approximates our aggregate revenue of $4.1 billion

for Fiscal 2014 and market capitalization of approximately $9.0 billion in late Fiscal 2014.

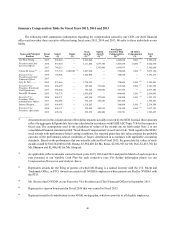

Our CC reviews market practices for compensating our desired talent pool, including data from our peer group, for the

three major components of our compensation program and total target compensation. When reviewing and analyzing the

amount of each major component and the total compensation opportunity for our NEOs, our CC reviews each component

at the 25th, 50th and 75th percentiles for our peer companies for guidance. Our CC reviews these pay levels as reference

points in its overall decision making, as indicative of the level of compensation necessary to attract, retain and motivate our

NEOs. Our CC sets the actual amount of each element of compensation and the total compensation opportunity of each

NEO based in part on its review of peer group data and in part on the factors discussed above and below in Compensation

Actions for Fiscal 2015 in respect of actual decisions for Fiscal 2015.