NVIDIA 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

59

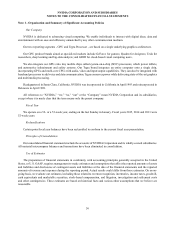

balance sheet amounts, which are remeasured at historical exchange rates. Gains or losses from foreign currency

remeasurement are included in “Other income (expense), net” in our Consolidated Statements of Income and to date have

not been significant.

The impact of gain or loss from foreign currency remeasurement included in determining other income (expense), net

for fiscal years 2015, 2014 and 2013 was $0.5 million, $4.7 million and $(1.5) million, respectively.

Income Taxes

We recognize federal, state and foreign current tax liabilities or assets based on our estimate of taxes payable or refundable

in the current fiscal year by tax jurisdiction. We recognize federal, state and foreign deferred tax assets or liabilities, as

appropriate, for our estimate of future tax effects attributable to temporary differences and carryforwards; and we record a

valuation allowance to reduce any deferred tax assets by the amount of any tax benefits that, based on available evidence

and judgment, are not expected to be realized.

United States income tax has not been provided on a portion of earnings of our non-U.S. subsidiaries to the extent that

such earnings are considered to be indefinitely reinvested.

Our calculation of current and deferred tax assets and liabilities is based on certain estimates and judgments and involves

dealing with uncertainties in the application of complex tax laws. Our estimates of current and deferred tax assets and

liabilities may change based, in part, on added certainty or finality to an anticipated outcome, changes in accounting standards

or tax laws in the United States, or foreign jurisdictions where we operate, or changes in other facts or circumstances. In

addition, we recognize liabilities for potential United States and foreign income tax contingencies based on our estimate of

whether, and the extent to which, additional taxes may be due. If we determine that payment of these amounts is unnecessary

or if the recorded tax liability is less than our current assessment, we may be required to recognize an income tax benefit

or additional income tax expense in our financial statements accordingly.

As of January 25, 2015, we had a valuation allowance of $261.0 million related to state and certain foreign deferred

tax assets that management determined are not likely to be realized due, in part, to projections of future taxable income and

potential utilization limitations of tax attributes acquired as a result of stock ownership changes. To the extent realization

of the deferred tax assets becomes more-likely-than-not, we would recognize such deferred tax asset as an income tax benefit

during the period.

Our deferred tax assets do not include the excess tax benefit related to stock-based compensation that are a component

of our federal and state net operating loss and research tax credit carryforwards in the amount of $411.9 million as of January

25, 2015. Consistent with prior years, the excess tax benefit reflected in our net operating loss and research tax credit

carryforwards will be accounted for as a credit to shareholders' equity, if and when realized. In determining if and when

excess tax benefits have been realized, we have elected to utilize the with-and-without approach with respect to such excess

tax benefits. We have also elected to ignore the indirect tax effects of stock-based compensation deductions for financial

and accounting reporting purposes, and specifically to recognize the full effect of the research tax credit in income from

operations.

We recognize the benefit from a tax position only if it is more-likely-than-not that the position would be sustained upon

audit based solely on the technical merits of the tax position. Our policy is to include interest and penalties related to

unrecognized tax benefits as a component of income tax expense. Please refer to Note 13 of these Notes to the Consolidated

Financial Statements for additional information.

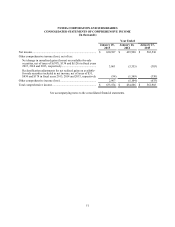

Comprehensive Income

Comprehensive income consists of net income and other comprehensive income (loss). Other comprehensive income

(loss) components include unrealized gains (losses) on available-for-sale securities, net of tax.