NVIDIA 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183

|

|

91

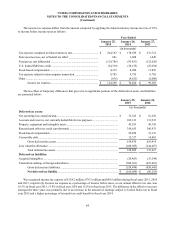

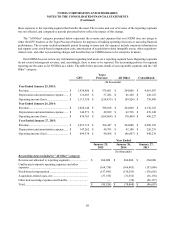

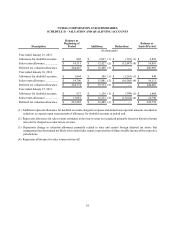

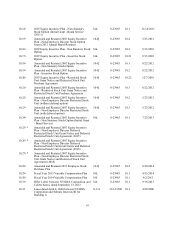

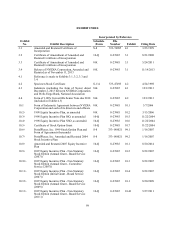

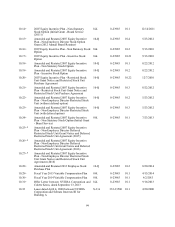

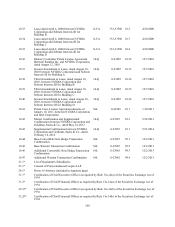

NVIDIA CORPORATION AND SUBSIDIARIES

SCHEDULE II – VALUATION AND QUALIFYING ACCOUNTS

Description

Balance at

Beginning of

Period Additions Deductions Balance at

End of Period

(In thousands)

Year ended January 25, 2015

Allowance for doubtful accounts.. $ 848 $ 2,837 (1) $ (793) (1) $ 2,892

Sales return allowance.................. $ 14,111 $ 12,427 (2) $ (12,447) (4) $ 14,091

Deferred tax valuation allowance.$ 244,487 $ 16,498 (3) $ — $ 260,985

Year ended January 26, 2014

Allowance for doubtful accounts.. $ 1,804 $ 309 (1) $ (1,265) (1) $ 848

Sales return allowance.................. $ 14,790 $ 15,881 (2) $ (16,560) (4) $ 14,111

Deferred tax valuation allowance.$ 224,774 $ 19,713 (3) $ — $ 244,487

Year ended January 27, 2013

Allowance for doubtful accounts.. $ 973 $ 1,139 (1) $ (308) (1) $ 1,804

Sales return allowance.................. $ 13,881 $ 16,533 (2) $ (15,624) (4) $ 14,790

Deferred tax valuation allowance.$ 212,285 $ 12,489 (3) $ — $ 224,774

(1) Additions represent allowance for doubtful accounts charged to expense and deductions represent amounts recorded as

reduction to expense upon reassessment of allowance for doubtful accounts at period end.

(2) Represents allowance for sales returns estimated at the time revenue is recognized primarily based on historical return

rates and is charged as a reduction to revenue.

(3) Represents change in valuation allowance primarily related to state and certain foreign deferred tax assets that

management has determined not likely to be realized due, in part, to projections of future taxable income of the respective

jurisdictions.

(4) Represents allowance for sales returns written off.