NVIDIA 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

85

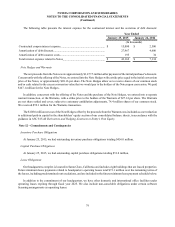

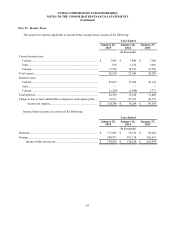

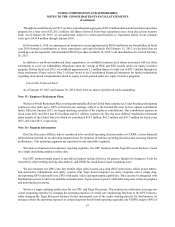

Our effective tax rate on income before tax for the fiscal years was lower than the United States federal statutory rate

of 35% due to income earned in jurisdictions, including British Virgin Islands, Hong Kong, China, Taiwan and United

Kingdom, where the tax rate is lower, favorable recognition of the U.S. federal research tax credit and release of tax reserves

as a result of the expiration of statutes of limitations in certain non-U.S. jurisdictions for which we had not previously

recognized related tax benefits.

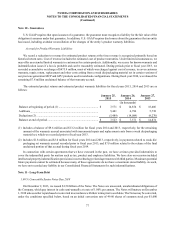

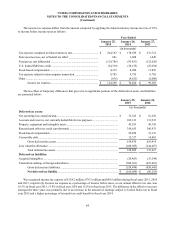

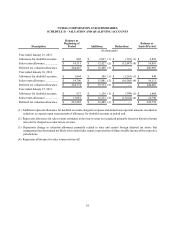

As of January 25, 2015 and January 26, 2014 we had a valuation allowance of $261.0 million and $244.5 million,

respectively, related to state and certain foreign deferred tax assets that management determined not likely to be realized

due, in part, to projections of future taxable income. To the extent realization of the deferred tax assets becomes more-likely-

than-not, we would recognize such deferred tax asset as an income tax benefit during the period.

Our deferred tax assets do not include the excess tax benefit related to stock-based compensation that are a component

of our federal and state net operating loss and research tax credit carryforwards in the amount of $411.9 million as of January

25, 2015. Consistent with prior years, the excess tax benefit reflected in our net operating loss and research tax credit

carryforwards will be accounted for as a credit to shareholders' equity, if and when realized.

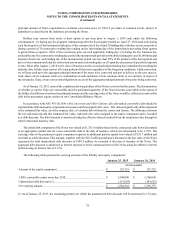

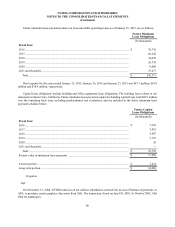

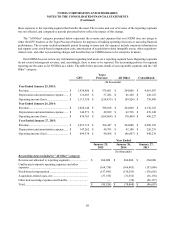

As of January 25, 2015, we had federal, state and foreign net operating loss carryforwards of $521.5 million, $667.2

million and $332.6 million, respectively. The federal and state carryforwards will expire beginning in fiscal year 2022 and

2016, respectively. The foreign net operating loss carryforwards of $316.7 million may be carried forward indefinitely and

the remainder of $15.9 million will begin to expire in fiscal year 2016. As of January 25, 2015, we had federal research tax

credit carryforwards of $429.6 million that will begin to expire in fiscal year 2018. We have state research tax credit

carryforwards of $411.7 million, of which $395.9 million is attributable to the State of California and may be carried over

indefinitely, and $15.8 million is attributable to various other states and will expire beginning in fiscal year 2016. We have

other state tax credit carryforwards of $3.0 million that will expire in fiscal year 2026 and foreign tax credit carryforwards

of $18.4 million, which may be refunded in fiscal years 2016 through 2019 if not utilized. Our tax attributes, net operating

loss and tax credit carryforwards, remain subject to audit and may be adjusted for changes or modification in tax laws, other

authoritative interpretations thereof, or other facts and circumstances. Utilization of federal, state, and foreign net operating

losses and tax credit carryforwards may also be subject to limitations due to ownership changes and other limitations provided

by the Internal Revenue Code and similar state and foreign tax provisions. If any such limitations apply, the federal, states,

or foreign net operating loss and tax credit carryforwards, as applicable, may expire or be denied before utilization.

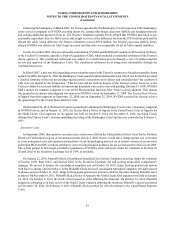

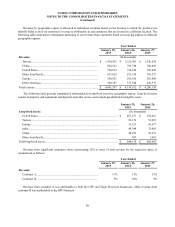

As of January 25, 2015, U.S. federal and state income taxes have not been provided on approximately $2.27 billion of

undistributed earnings of non-United States subsidiaries as such earnings are considered to be indefinitely reinvested. We

have not provided the amount of unrecognized deferred tax liabilities for temporary differences related to investments in

our foreign subsidiaries as the determination of such amount is not practicable.

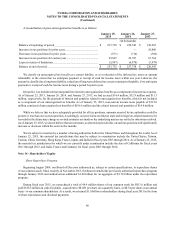

As of January 25, 2015, we had $253.7 million of gross unrecognized tax benefits, of which $228.7 million would

affect our effective tax rate if recognized. However, approximately $45.3 million of the unrecognized tax benefits were

related to state income tax positions taken, that, if recognized, would be in the form of a carryforward deferred tax asset

that would likely attract a full valuation allowance. The $228.7 million of unrecognized tax benefits as of January 25, 2015

consisted of $106.6 million recorded in non-current income taxes payable and $122.1 million reflected as a reduction to

the related deferred tax assets.