NVIDIA 2015 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

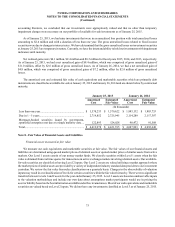

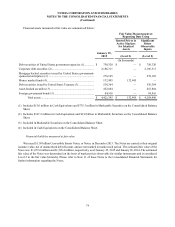

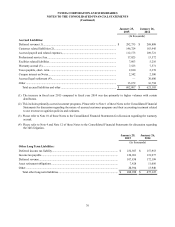

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

75

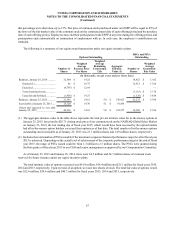

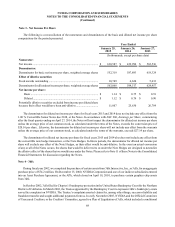

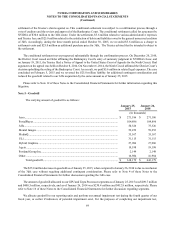

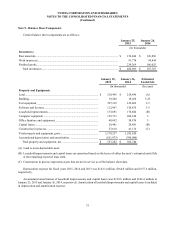

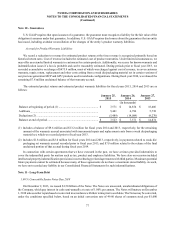

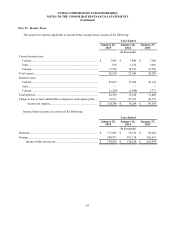

Note 9 - Balance Sheet Components

Certain balance sheet components are as follows:

January 25,

2015 January 26,

2014

(In thousands)

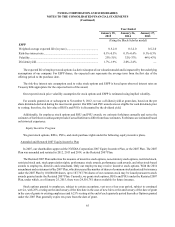

Inventories:

Raw materials................................................................................................................... $ 156,846 $ 126,896

Work in-process................................................................................................................ 91,778 94,844

Finished goods.................................................................................................................. 234,269 166,025

Total inventories.......................................................................................................... $ 482,893 $ 387,765

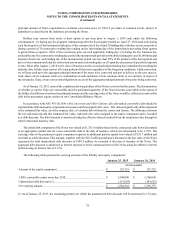

January 25,

2015 January 26,

2014 Estimated

Useful Life

(In thousands) (In years)

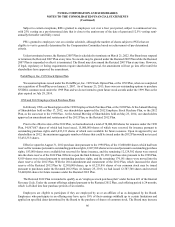

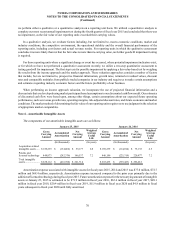

Property and Equipment:

Land...................................................................................................... $ 218,496 $ 218,496 (A)

Building ................................................................................................ 19,268 19,268 5-25

Test equipment...................................................................................... 397,319 412,862 3-5

Software and licenses ........................................................................... 112,967 120,435 3-5

Leasehold improvements...................................................................... 173,691 178,884 (B)

Computer equipment ............................................................................ 152,733 204,344 3

Office furniture and equipment............................................................. 48,692 58,874 5

Capital leases ........................................................................................ 28,481 28,481 (B)

Construction in process......................................................................... 27,610 41,176 (C)

Total property and equipment, gross .................................................... 1,179,257 1,282,820

Accumulated depreciation and amortization ........................................ (621,975)(700,080)

Total property and equipment, net................................................... $ 557,282 $ 582,740

(A) Land is a non-depreciable asset.

(B) Leasehold improvements and capital leases are amortized based on the lesser of either the asset’s estimated useful life

or the remaining expected lease term.

(C) Construction in process represents assets that are not in service as of the balance sheet date.

Depreciation expense for fiscal years 2015, 2014 and 2013 was $143.1 million, $164.0 million and $157.6 million,

respectively.

Accumulated amortization of leasehold improvements and capital leases was $139.6 million and $146.4 million at

January 25, 2015 and January 26, 2014, respectively. Amortization of leasehold improvements and capital leases is included

in depreciation and amortization expense.