NVIDIA 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

63

retrospective approach. We are currently evaluating the impact of this accounting guidance on our consolidated financial

statements and have not yet determined which transition method we will apply.

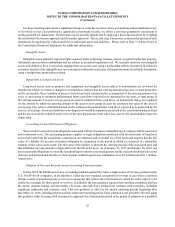

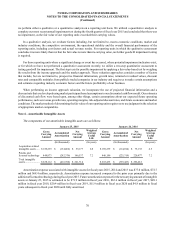

Note 2 - Stock-Based Compensation

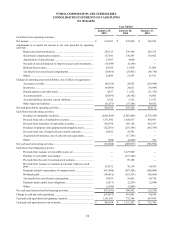

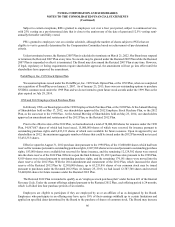

Our stock-based compensation expense is associated with stock options, RSUs, PSUs and our ESPP.

Our consolidated statements of income include stock-based compensation expense, net of amounts capitalized as

inventory, as follows:

Year Ended

January 25,

2015 January 26,

2014 January 27,

2013

(In thousands)

Cost of revenue..................................................................................... $ 12,022 $ 10,688 $ 10,490

Research and development ................................................................... 88,355 82,940 82,157

Sales, general and administrative ......................................................... 57,464 42,667 44,015

Total...................................................................................................... $ 157,841 $ 136,295 $ 136,662

Stock-based compensation capitalized in inventories resulted in a net charge of $0.1 million, $0.1 million and $0.4

million in cost of revenue during the fiscal years 2015, 2014 and 2013, respectively.

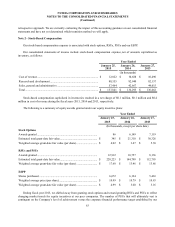

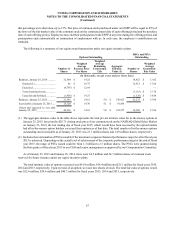

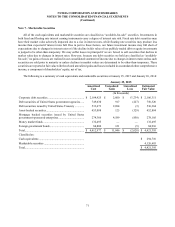

The following is a summary of equity awards granted under our equity incentive plans:

Year Ended

January 25, January 26, January 27,

2015 2014 2013

(In thousands, except per share data)

Stock Options

Awards granted.................................................................................... 86 6,149 7,119

Estimated total grant-date fair value.................................................... $ 345 $ 21,310 $ 38,326

Weighted average grant-date fair value (per share)............................. $ 4.02 $ 3.47 $ 5.38

RSUs and PSUs

Awards granted.................................................................................... 12,912 10,757 8,136

Estimated total grant-date fair value.................................................... $ 228,223 $ 144,798 $ 112,795

Weighted average grant-date fair value (per share)............................. $ 17.68 $ 13.46 $ 13.86

ESPP

Shares purchased.................................................................................. 6,672 6,124 5,463

Weighted average price (per share)...................................................... $ 10.99 $ 10.79 $ 10.83

Weighted average grant-date fair value (per share)............................. $ 4.99 $ 5.60 $ 5.16

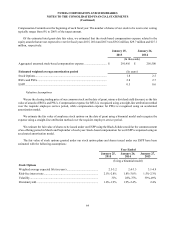

During fiscal year 2015, we shifted away from granting stock options and toward granting RSUs and PSUs to reflect

changing market trends for equity incentives at our peer companies. The number of PSUs that will ultimately vest is

contingent on the Company’s level of achievement versus the corporate financial performance target established by our