NVIDIA 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

64

Compensation Committee in the beginning of each fiscal year. The number of shares of our stock to be received at vesting

typically ranges from 0% to 200% of the target amount.

Of the estimated total grant-date fair value, we estimated that the stock-based compensation expense related to the

equity awards that are not expected to vest for fiscal years 2015, 2014 and 2013 was $36.6 million, $29.7 million and $27.1

million, respectively.

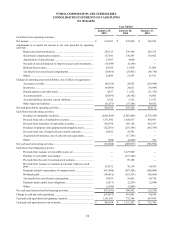

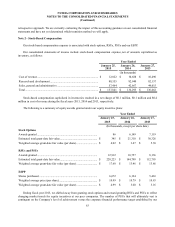

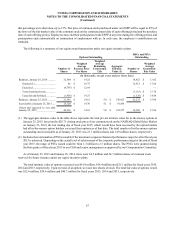

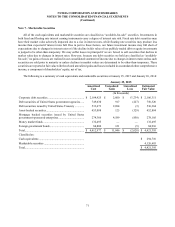

January 25, January 26,

2015 2014

(In thousands)

Aggregated unearned stock-based compensation expense ............................... $ 291,416 $ 256,500

Estimated weighted average amortization period (In years)

Stock Options.................................................................................................... 1.8 2.5

RSUs and PSUs................................................................................................. 2.8 2.7

ESPP.................................................................................................................. 0.5 0.6

Valuation Assumptions

We use the closing trading price of our common stock on the date of grant, minus a dividend yield discount, as the fair

value of awards of RSUs and PSUs. Compensation expense for RSUs is recognized using a straight-line attribution method

over the requisite employee service period, while compensation expense for PSUs is recognized using an accelerated

amortization model.

We estimate the fair value of employee stock options on the date of grant using a binomial model and recognize the

expense using a straight-line attribution method over the requisite employee service period.

We estimate the fair value of shares to be issued under our ESPP using the Black-Scholes model at the commencement

of an offering period in March and September of each year. Stock-based compensation for our ESPP is expensed using an

accelerated amortization model.

The fair value of stock options granted under our stock option plans and shares issued under our ESPP have been

estimated with the following assumptions:

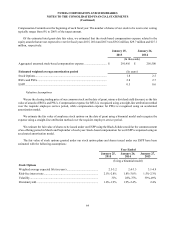

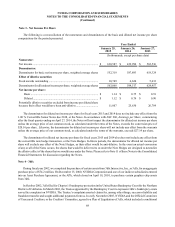

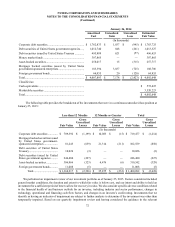

Year Ended

January 25,

2015 January 26,

2014 January 27,

2013

(Using a binomial model)

Stock Options

Weighted average expected life (in years)............................................ 2.5-3.2 2.4-3.5 3.1-4.9

Risk-free interest rate............................................................................ 2.5%-2.8% 1.8%-3.0% 1.5%-2.3%

Volatility ............................................................................................... 31% 28%-37% 39%-49%

Dividend yield ...................................................................................... 1.8%-1.9% 1.9%-2.4% 2.4%