NVIDIA 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

62

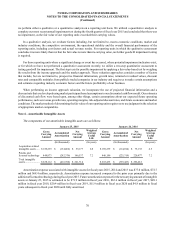

For those reporting units where a significant change or event has occurred, where potential impairment indicators exist,

or for which we have not performed a quantitative assessment recently, we utilize a two-step quantitative assessment to

testing goodwill for impairment. The first step tests for possible impairment by applying a fair value-based test by weighing

the results from the income approach and the market approach. The second step, if necessary, measures the amount of such

impairment by applying fair value-based tests to individual assets and liabilities. Please refer to Note 5 of these Notes to

the Consolidated Financial Statements for additional information.

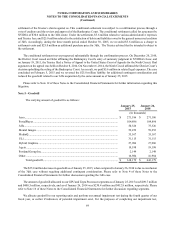

Intangible Assets

Intangible assets primarily represent rights acquired under technology licenses, patents, acquired intellectual property,

trademarks and customer relationships and are subject to an annual impairment test. We currently amortize our intangible

assets with definitive lives over periods ranging from one to ten years using a method that reflects the pattern in which the

economic benefits of the intangible asset are consumed or otherwise used up or, if that pattern cannot be reliably determined,

using a straight-line amortization method.

Impairment of Long-Lived Assets

Long-lived assets, such as property and equipment and intangible assets subject to amortization are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount of an asset, or asset group may

not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an

asset, or asset group to estimated undiscounted future cash flows expected to be generated by the asset, or asset group. If

the carrying amount of an asset or asset group exceeds its estimated future cash flows, an impairment charge is recognized

for the amount by which the carrying amount of the asset or asset group exceeds the estimated fair value of the asset or

asset group. Fair value is determined based on the estimated discounted future cash flows expected to be generated by the

asset or asset group. Assets and liabilities to be disposed of would be separately presented in the consolidated balance sheet

and the assets would be reported at the lower of the carrying amount or fair value less costs to sell, and would no longer be

depreciated.

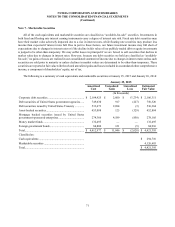

Accounting for Asset Retirement Obligations

We account for asset retirement obligations associated with the retirement of tangible long-lived assets and the associated

asset retirement costs. The accounting guidance applies to legal obligations associated with the retirement of long-lived

assets that result from the acquisition, construction, development and/or normal use of the assets and requires that the fair

value of a liability for an asset retirement obligation be recognized in the period in which it is incurred if a reasonable

estimate of fair value can be made. The fair value of the liability is added to the carrying amount of the associated asset and

this additional carrying amount is depreciated over the life of the asset. As of January 25, 2015 and January 26, 2014, our

asset retirement obligations to return the leasehold improvements at our headquarters facility and certain laboratories at our

domestic and international facilities to their original condition upon lease termination were $7.4 million and $11.1 million,

respectively.

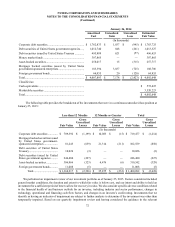

Adoption of New and Recently Issued Accounting Pronouncements

In May 2014, the FASB issued a new accounting standard update that creates a single source of revenue guidance under

U.S. GAAP for all companies, in all industries. Under the new standard, recognition of revenue occurs when a customer

obtains control of promised goods or services in an amount that reflects the consideration to which the entity expects to be

entitled in exchange for those goods or services. In addition, the new guidance requires that reporting companies disclose

the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers, including

significant judgments and estimates used. This new guidance is effective for annual reporting periods beginning after

December 15, 2016, including interim periods within that reporting period. Early adoption is not permitted. We will adopt

this guidance either by using a full retrospective approach for all periods presented in the period of adoption or a modified