NVIDIA 2015 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

74

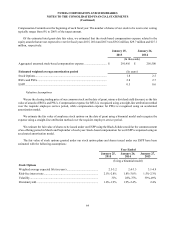

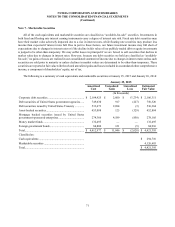

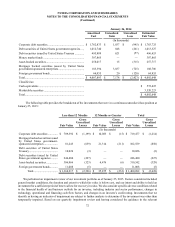

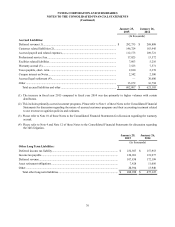

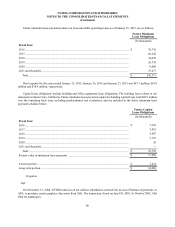

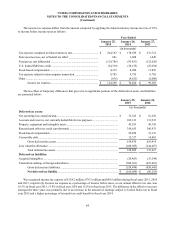

Financial assets measured at fair value are summarized below:

Fair Value Measurement at

Reporting Date Using

Quoted Prices in

Active Markets

for Identical

Assets

Significant

Other

Observable

Inputs

January 25,

2015 (Level 1) (Level 2)

(In thousands)

Debt securities of United States government agencies (1).............. $ 750,320 $ — $ 750,320

Corporate debt securities (2)........................................................... 2,186,311 — 2,186,311

Mortgage backed securities issued by United States government-

sponsored enterprises (3) ................................................................ 278,105 — 278,105

Money market funds (4).................................................................. 132,495 132,495 —

Debt securities issued by United States Treasury (3)...................... 536,364 — 536,364

Asset-backed securities (3) ............................................................. 452,884 — 452,884

Foreign government bonds (3)........................................................ 84,916 — 84,916

Total assets.......................................................................... $ 4,421,395 $ 132,495 $ 4,288,900

(1) Includes $15.0 million in Cash Equivalents and $735.3 million in Marketable Securities on the Consolidated Balance

Sheet.

(2) Includes $147.2 million in Cash Equivalents and $2.0 billion in Marketable Securities on the Consolidated Balance

Sheet.

(3) Included in Marketable Securities on the Consolidated Balance Sheet.

(4) Included in Cash Equivalents on the Consolidated Balance Sheet.

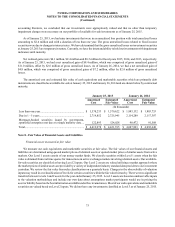

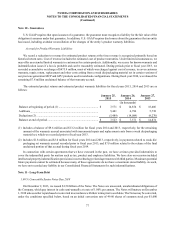

Financial liabilities measured at fair value

We issued $1.50 billion Convertible Senior Notes, or Notes, in December 2013. The Notes are carried at their original

issuance value, net of unamortized debt discount, and are not marked to market each period. The estimated fair value of the

Notes was $1,679.6 million and $1,528.4 million, respectively, as of January 25, 2015 and January 26, 2014. The estimated

fair value of the Notes was determined on the basis of market prices observable for similar instruments and is considered

Level 2 in the fair value hierarchy. Please refer to Note 11 of these Notes to the Consolidated Financial Statements for

further information regarding the Notes.