NVIDIA 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

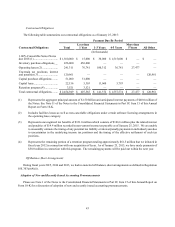

government bonds. These investments are denominated in United States dollars. As of January 25, 2015, we did not have

any investments in auction-rate preferred securities.

Please refer to Note 7 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report

on Form 10-K for additional information.

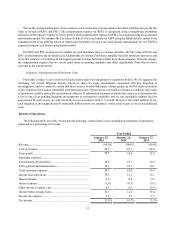

As of January 25, 2015 and January 26, 2014, we had $4.62 billion and $4.67 billion, respectively, in cash, cash

equivalents and marketable securities. Our investment policy requires the purchase of high grade investment securities and

the diversification of asset types and includes certain limits on our portfolio duration, as specified in our investment policy

guidelines. These guidelines also limit the amount of credit exposure to any one issue, issuer or type of instrument. As of

January 25, 2015, we were in compliance with our investment policy. As of January 25, 2015, our investments in U.S.

government agencies and U.S. government sponsored enterprises represented 35% of our total investment portfolio, while

the financial sector accounted for 30% of our total investment portfolio. All of our investments are with A/A3 or better rated

securities.

We performed an impairment review of our investment portfolio as of January 25, 2015. Based on our quarterly

impairment review, we concluded that our investments were appropriately valued and did not record any impairment during

fiscal year 2015.

Net realized gains were $0.1 million, $2.4 million and $0.5 million for fiscal years 2015, 2014 and 2013, respectively. As

of January 25, 2015, we had a net unrealized gain of $8.4 million, which was comprised of gross unrealized gains of $11.0

million, offset by $2.6 million of gross unrealized losses. As of January 26, 2014, we had a net unrealized gain of $4.8

million, which was comprised of gross unrealized gains of $7.2 million, offset by $2.4 million of gross unrealized losses.

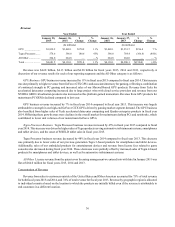

Our accounts receivable are highly concentrated. Two customers accounted for 30% of our accounts receivable balance

at January 25, 2015. We maintain an allowance for doubtful accounts for estimated losses resulting from the inability of

our customers to make required payments. This allowance consists of an amount identified for specific customers and an

amount based on overall estimated exposure.

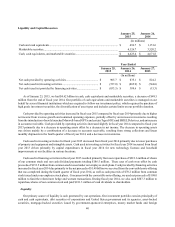

Our cash balances are held in numerous locations throughout the world, including substantial amounts held outside of

the United States. As of January 25, 2015, we had cash, cash equivalents and marketable securities of $1.72 billion held

within the United States and $2.90 billion held outside of the United States. Most of the amounts held outside the United

States may be repatriated to the United States but, under current law, would be subject to U.S. federal income taxes, less

applicable foreign tax credits. Further, repatriation of some foreign balances may be restricted by local laws. As of January

25, 2015, we have not provided for U.S. federal and state income taxes on approximately $2.27 billion of undistributed

earnings of non-United States subsidiaries, as such earnings are considered indefinitely reinvested outside the United States.

Although we have no current need to do so, if we repatriate foreign earnings for cash requirements in the United States, we

would incur U.S. federal and state income tax, less applicable foreign tax credits, and reduced by the current amount of our

U.S. federal and state net operating loss and tax credit carryforwards. Further, in addition to the $1.72 billion of cash, cash

equivalents and marketable securities held within the United States and available to fund our U.S. operations and any other

U.S. cash needs, we have access to external sources of financing if cash is needed in the United States other than by

repatriation of foreign earnings where U.S. income tax may otherwise be due. Accordingly, we do not reasonably expect

any material effect on our business, as a whole, or to our financial flexibility with respect to our current cash balances held

outside of the United States.

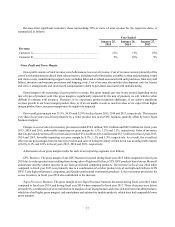

Dividend payments and any share repurchases must be made from cash held in the United States. For fiscal year 2015,

we made total cash dividend payments of $186.5 million and repurchased $813.6 million of our common stock, utilizing a

significant amount of our U.S. cash balance previously taxed as of January 25, 2015.