NVIDIA 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

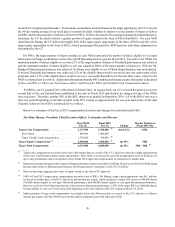

42

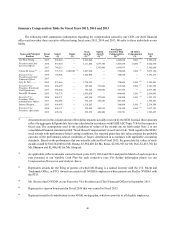

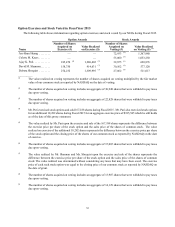

(3) Based on the target aggregate fair value of equity awards at the time of CC approval.

(4) Target equity opportunity was $1.6 million (100,000 shares), set based on market data, overall CC objectives and internal pay equity.

35% of target shares (or 35,000 shares) were allocated to RSUs and 65% of target shares (or 65,000 shares) were allocated to PSUs

(where 16,250 shares were eligible to vest upon Threshold performance and 130,000 shares were eligible to vest upon Maximum

performance). Based on our Non-GAAP Operating Income achievement above Maximum, 200% of the target PSUs (or 130,000

shares) became eligible to vest over a four year period beginning on the date of grant (with 25% vesting on March 18, 2015).

(5) Market position of target total compensation was lower than that of Mr. Shannon and Ms. Shoquist, but was determined by the CC

to be appropriate based on the subjective determination of the CC.

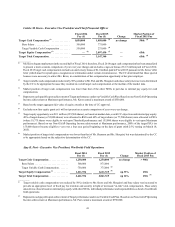

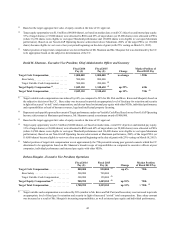

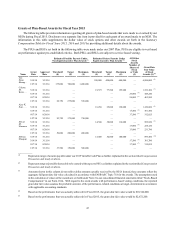

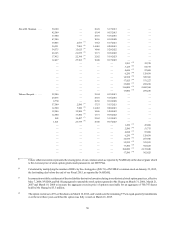

David M. Shannon - Executive Vice President, Chief Administrative Officer and Secretary

Fiscal 2014

Pay ($) Fiscal 2015

Pay ($) Change Market Position of

Fiscal 2015 Pay

Target Cash Compensation . . . . . . . . . . . . . . 1,000,000 1,000,000 (1) no change > 90th

Base Salary. . . . . . . . . . . . . . . . . . . . . . . . . . 500,000 800,000

Target Variable Cash Compensation . . . . . . 500,000 200,000 (2)

Target Equity Compensation (3) . . . . . . . . . . . 1,049,130 1,348,630 (4) up 29% 65th

Target Total Compensation . . . . . . . . . . . . . . 2,049,130 2,348,630 up 15% 75th (5)

__________

(1) Target variable cash compensation was reduced by 60% (as compared to 50% for Mr. Puri and Mses. Kress and Shoquist) based on

the subjective decision of the CC. Base salary was increased to provide an appropriate level of fixed pay for retention and security

in light of increased “at-risk” total compensation, and chosen based on internal pay equity with other NEOs, individual performance

and responsibilities as head of human resources, legal and intellectual property licensing.

(2) Represents cash payable upon achievement of Target performance under our Variable Cash Plan. Based on our Non-GAAP Operating

Income achievement at Maximum performance, Mr. Shannon earned a maximum award of $400,000.

(3) Based on the target aggregate fair value of equity awards at the time of CC approval.

(4) Target equity opportunity was $1.3 million (84,000 shares), set based on market data, overall CC objectives and internal pay equity.

31% of target shares (or 26,000 shares) were allocated to RSUs and 69% of target shares (or 58,000 shares) were allocated to PSUs

(where 14,500 shares were eligible to vest upon Threshold performance and 116,000 shares were eligible to vest upon Maximum

performance). Based on our Non-GAAP Operating Income achievement at Maximum performance, 200% of the target PSUs (or

116,000 shares) became eligible to vest over a four year period beginning on the date of grant (with 25% vesting on March 18, 2015).

(5) Market position of target total compensation was at approximately the 75th percentile among peer general counsels which the CC

determined to be appropriate based on Mr. Shannon’s broader scope of responsibilities as compared to executive officers at peer

companies, individual performance and internal pay equity with other NEOs.

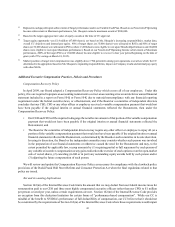

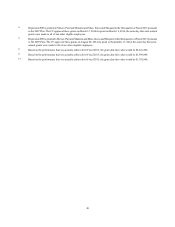

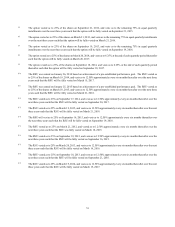

Debora Shoquist - Executive Vice President, Operations

Fiscal 2014

Pay ($) Fiscal 2015

Pay ($) Change Market Position

of Fiscal 2015 Pay

Target Cash Compensation . . . . . . . . . . . . . . . . 800,000 850,000 (1) up 6% 75th

Base Salary . . . . . . . . . . . . . . . . . . . . . . . . . . . 500,000 700,000

Target Variable Cash Compensation . . . . . . . . 300,000 150,000 (2)

Target Equity Compensation (3) . . . . . . . . . . . . 908,952 1,409,185 (4) up 55% 75th

Target Total Compensation . . . . . . . . . . . . . . . . 1,708,952 2,259,185 up 32% > 75th (5)

__________

(1) Target variable cash compensation was reduced by 50% (similar to Ms. Kress and Mr. Puri) and base salary was increased to provide

an appropriate level of fixed pay for retention and security in light of increased “at-risk” total compensation. Base salary amount

was increased as a result of Ms. Shoquist’s increasing responsibilities, as well as internal pay equity and individual performance.