Chevron 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

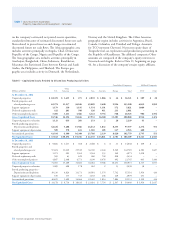

Noteworthy amounts in the categories of liquids proved

reserve changes for 2010 through 2012 are discussed below:

Revisions In 2010, net revisions increased reserves 82

million barrels. For consolidated companies, improved reser-

voir performance accounted for a majority of the 63 million

barrel increase in the United States. Increases in the other

regions were partially oset by Asia, which decreased as a

result of the eect of higher prices on entitlement volumes in

Kazakhstan. For aliated companies, the price eect on enti-

tlement volumes at TCO decreased reserves by33 million

barrels.

In 2011, net revisions increased reserves 235 million

barrels. For consolidated companies, improved reservoir

performance accounted for a majority of the 63 million bar-

rel increase in the United States. In Africa, improved eld

performance drove the 60 million barrel increase. In Asia,

increases from improved reservoir performance were partially

oset by the eects of higher prices on entitlement volumes.

Synthetic oil reserves in Canada increased by 32 million bar-

rels, primarily due to geotechnical revisions. For aliated

companies, improved facility and reservoir performance was

partially oset by the price eect on entitlement volumes at

TCO.

In 2012, net revisions increased reserves 390 million

barrels. Improved eld performance and drilling associated

with Gulf of Mexico projects accounted for the majority of

the 104 million barrel increase in the United States. In Asia,

drilling results across numerous assets drove the 97 million

barrel increase. Improved eld performance from various

Nigeria and Angola producing assets was primarily respon-

sible for the 66 million barrel increase in Africa. Improved

plant eciency for the TCO aliate was responsible for a

large portion of the 59 million barrel increase.

Improved Recovery In 2010, improved recovery

increased volumes by 77 million barrels. Reserves in Africa

increased 58 million barrels due primarily to secondary recov-

ery performance in Nigeria.

In 2011, improved recovery increased volumes by

58 million barrels. Reserves in Africa increased 48 million

barrels due primarily to secondary recovery performance in

Nigeria.

In 2012, improved recovery increased reserves by 77 mil-

lion barrels, primarily due to secondary recovery performance

in Africa and in Gulf of Mexico elds in the United States.

Extensions and Discoveries In 2010, extensions and dis-

coveries increased reserves 63 million barrels. e United States

and Other Americas each increased reserves 19 million barrels,

and Asia increased reserves 16 million barrels. No single area in

the United States was individually signicant. Drilling activ-

ity in Argentina and Brazil accounted for the majority of the

increase in Other Americas. In Asia, the increase was primarily

related to activity in Azerbaijan.

In 2011, extensions and discoveries increased reserves 299

million barrels. In the United States, additions related to two

Gulf of Mexico projects resulted in the majority of the 140

million barrel increase. In Australia, the Wheatstone Project

increased liquid volumes 65 million barrels. Africa and Other

Americas increased reserves 34 million and 30 million barrels,

respectively, following the start of new projects in these areas.

In Europe, a project in the United Kingdom increased reserves

26 million barrels.

In 2012, extensions and discoveries increased reserves 218

million barrels. In Other Americas, extensions and discover-

ies increased reserves 101 million barrels primarily due to the

initial booking of the Hebron project in Canada. In the United

States, additions at several Gulf of Mexico projects and drilling

activity in the mid-continent region were primarily responsible

for the 77 million barrel increase.

Purchases In 2011, purchases increased worldwide liq-

uid volumes 42 million barrels. e acquisition of additional

acreage in Canada increased synthetic oil reserves 40 million

barrels.

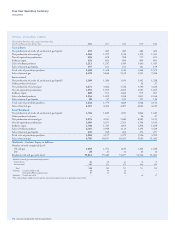

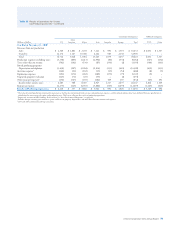

Table V Reserve Quantity Information – Continued

80 Chevron Corporation 2012 Annual Report