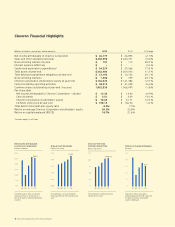

Chevron 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

12 Chevron Corporation 2012 Annual Report

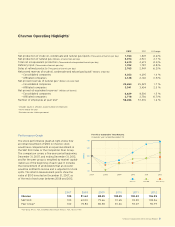

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

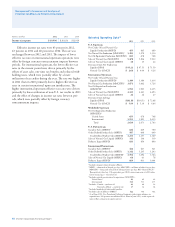

e company’s worldwide net oil-equivalent production

in 2012 averaged 2.610 million barrels per day. About one-

fth of the company’s net oil-equivalent production in 2012

occurred in the OPEC-member countries of Angola, Nigeria,

Venezuela and the Partitioned Zone between Saudi Arabia

and Kuwait. OPEC quotas had no eect on the company’s

net crude oil production in 2012 or 2011. At their December

2012 meeting, members of OPEC supported maintaining the

current production quota of 30 million barrels per day, which

has been in eect since December 2008.

e company estimates that oil-equivalent production

in 2013 will average approximately 2.650 million barrels per

day based on an average Brent price of $112 per barrel for

the full-year 2012. is estimate is subject to many factors

and uncertainties, including quotas that may be imposed by

OPEC, price eects on entitlement volumes, changes in s-

cal terms or restrictions on the scope of company operations,

delays in project startups or ramp-ups, uctuations in demand

for natural gas in various markets, weather conditions that

may shut in production, civil unrest, changing geopolitics,

delays in completion of maintenance turnarounds, greater-

than-expected declines in production from mature elds,

or other disruptions to operations. e outlook for future

production levels is also aected by the size and number of

economic investment opportunities and, for new, large-scale

projects, the time lag between initial exploration and the

beginning of production. Investments in upstream projects

generally begin well in advance of the start of the associated

crude oil and natural gas production. A signicant majority

of Chevron’s upstream investment is made outside the United

States.

Refer to the “Results of Operations” section on pages

14 through 15 for additional discussion of the company’s

upstream business.

Refer to Table V beginning on page 76 for a tabulation of

the company’s proved net oil and gas reserves by geographic

area, at the beginning of 2010 and each year-end from 2010

through 2012, and an accompanying discussion of major

changes to proved reserves by geographic area for the three-

year period ending December 31, 2012.

On November 7, 2011, while drilling a development

well in the deepwater Frade Field about 75 miles oshore

Brazil, an unanticipated pressure spike caused oil to migrate

from the well bore through a series of ssures to the sea oor,

emitting approximately 2,400 barrels of oil. e source of

the seep was substantially contained within four days and

the well was plugged and abandoned. No evidence of any

coastal or wildlife impacts related to this seep has emerged.

On March 14, 2012, the company identied a small, second

seep in a dierent part of the eld. As a precautionary mea-

sure, the company and its partners decided to temporarily

suspend eld production and received approval from Brazil’s

National Petroleum Agency (ANP) to do so. Chevron and its

partners are cooperating with the Brazilian authorities. On

July 19, 2012, ANP issued its nal investigative report on the

November 2011 incident. A Brazilian federal district prosecu-

tor led two civil lawsuits seeking $10.7 billion in damages

for each of the two seeps. e company is not aware of any

basis for damages to be awarded in any civil lawsuit. On July

31, 2012, a court presiding over the civil litigation entered a

preliminary injunction barring Chevron from conducting oil

production and transportation activities in Brazil pending

completion of the legal proceedings commenced by the fed-

eral district prosecutor and the ongoing proceedings of ANP

and the Brazilian environment and natural resources regula-

tory agency. On September 28, 2012, the injunction was

modied to clarify that Chevron may continue its contain-

ment and mitigation activities under supervision of ANP. On

appeal, on November 27, 2012, the injunction was revoked

in its entirety. e federal district prosecutor also led crimi-

nal charges against 11 Chevron employees. Jurisdiction for

all three matters was moved from Campos to a court in Rio

de Janeiro. On February 19, 2013, the court dismissed the

criminal matter, which is subject to appeal by the prosecutor.

Chevron has submitted to ANP a plan for restarting limited

0.0

12.5

7.5

5.0

10.0

2.5

Net proved reserves for

consolidated companies and

affiliated companies increased

1 percent in 2012.

*2012, 2011, 2010 and 2009 include

barrels of oil-equivalent (BOE)

reserves for Canadian synthetic oil.

Net Proved Reserves

Billions of BOE*

United States

Other Americas

Africa

Asia

Australia

Europe

Affiliates

11.3

08 09

10

11

12

Net Proved Reserves

Liquids vs. Natural Gas

Billions of BOE

0908 10 11 12

11.3

Natural Gas

Liquids

12.5

7.5

0.0

10.0

5.0

2.5

Reserve replacement rate in 2012

was 112 percent.