Chevron 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

20 Chevron Corporation 2012 Annual Report

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

2012, the company had purchased 97.7 million shares for

$10.0 billion.

Capital and exploratory expenditures Total expendi-

tures for 2012 were $34.2 billion, including $2.1 billion for the

company’s share of equity-aliate expenditures. In 2011 and

2010, expenditures were $29.1 billion and $21.8 billion,

respectively, including the company’s share of aliates’ expen-

ditures of $1.7 billion and $1.4 billion, respectively.

Of the $34.2 billion of expenditures in 2012, 89 percent,

or $30.4 billion, was related to upstream activities. Approxi-

mately 89 percent and 87 percent were expended for

upstream operations in 2011 and 2010. International

upstream accounted for about 72 percent of the worldwide

upstream investment in 2012, about 68percent in 2011 and

about 82 percent in 2010. ese amounts exclude the acquisi-

tion of Atlas Energy, Inc., in 2011.

e company estimates that 2013 capital and exploratory

expenditures will be $36.7 billion, including $3.3 billion of

spending by aliates. Approximately 90 percent of thetotal,

or $33 billion, is budgeted for exploration and production

activities. Approximately $25.5 billion, or 77 percent, of

this amount is for projects outside the United States. Spending

in 2013 is primarily focused on major development projects

in Angola, Australia, Brazil, Canada, China, Kazakhstan,

Nigeria, Republic of Congo, Russia, the United Kingdom

and the U.S. Gulf of Mexico. Also included is funding for

enhancing recovery and mitigating natural eld declines for

currently-producing assets, and for focused exploration and

appraisal activities.

Worldwide downstream spending in 2013 is estimated at

$2.7 billion, with about $1.4 billion for projects in the United

States. Major capital outlays include projects under construc-

tion at reneries in the United States, expansion of additives

production capacity in Singapore and chemicals projects in

the United States.

Investments in technology companies, power genera-

tion and other corporate businesses in 2013 are budgeted at

$1 billion.

Noncontrolling interests e company had noncon-

trolling interests of $1,308 million and $799 million at

December 31, 2012 and 2011, respectively. Distributions to

noncontrolling interests totaled $41 million and $71 million

in 2012 and 2011, respectively.

Pension Obligations Information related to pension

plan contributions is included on page 62 in Note 20 to

the Consolidated Financial Statements under the heading

“Cash Contributions and Benet Payments.” Refer also to

the discussion of pension accounting in “Critical Accounting

Estimates and Assumptions,” beginning on page 24.

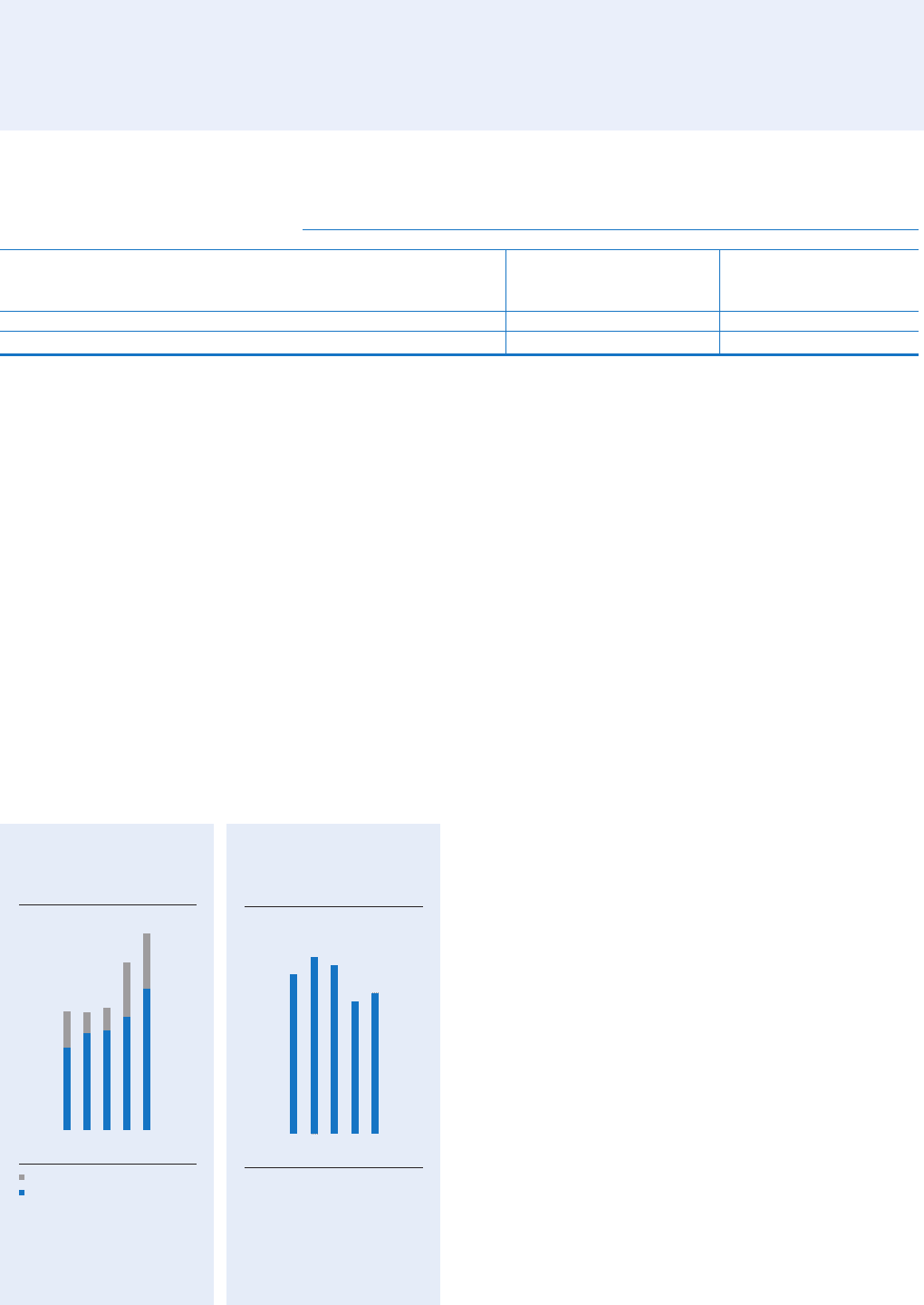

0.0

12.0

9.0

3.0

6.0

Percent

The ratio increased to 8.2 percent

at the end of 2012 due to higher

debt, partially offset by an increase

in Stockholders’ Equity.

Ratio of Total Debt to Total

Debt-Plus-Chevron Corporation

Stockholders’ Equity

0908 10 11 12

8.2%

0.0

32.0

16.0

24.0

8.0

Upstream —

Capital & Exploratory

Expenditures*

Billions of dollars

United States

International

Exploration and production

expenditures were 18 percent

higher than 2011.

* Includes equity in affiliates.

Excludes the acquisition of Atlas

Energy, Inc., in 2011.

0908 10 11 12

$30.4

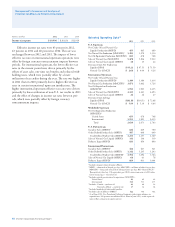

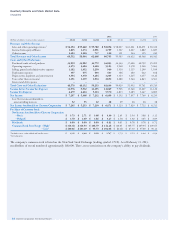

Capital and Exploratory Expenditures

2012 2011 2010

Millions of dollars U.S. Int’l. Total U.S. Int’l. Total U.S. Int’l. Total

Upstream1 $ 8,531 $ 21,913 $ 30,444 $ 8,318 $ 17,554 $ 25,872 $ 3,450 $ 15,454 $ 18,904

Downstream 1,913 1,259 3,172 1,461 1,150 2,611 1,456 1,096 2,552

All Other 602 11 613 575 8 583 286 13 299

Total $ 11,046 $ 23,183 $ 34,229 $ 10,354 $ 18,712 $ 29,066 $ 5,192 $ 16,563 $ 21,755

Total, Excluding Equity in Aliates $ 10,738 $ 21,374 $ 32,112 $ 10,077 $ 17,294 $ 27,371 $ 4,934 $ 15,433 $ 20,367

1 Excludes the acquisition of Atlas Energy, Inc., in 2011.